WTI Crude - Bulls Are Pushing Ahead

rhboskres

Publish date: Wed, 24 Feb 2021, 05:39 PM

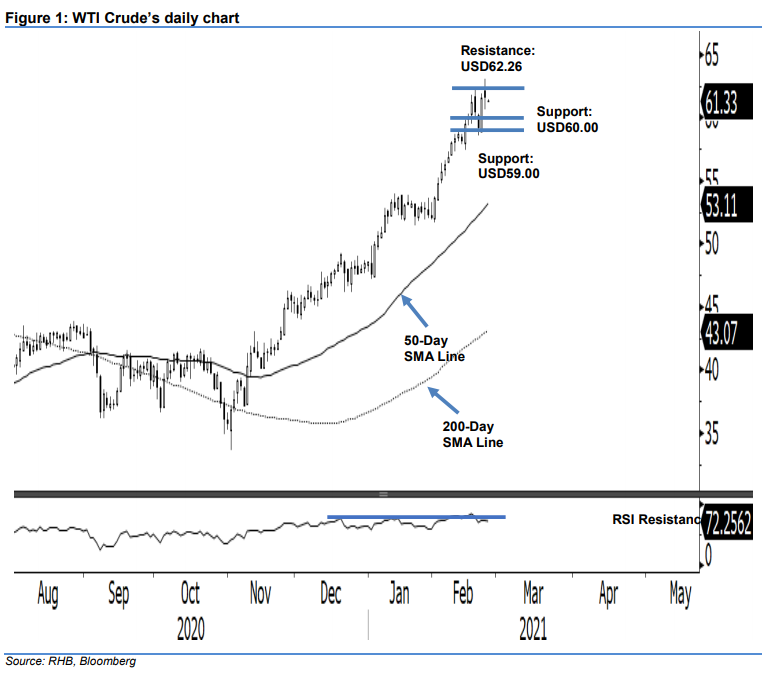

Maintain long positions. The WTI Crude did not extend its minor consolidation phase as we had been expecting, as it continued to charge upwards to mark a higher high – but not without facing selling pressure. After briefly breaking above the recent high of USD62.26, with a high of USD63.00, the commodity experienced a sharp retracement – ending the session USD0.18 higher at USD61.67. While the RSI readings still suggest an overbought condition, the commodity continues to show positive price momentum, and there are no signals of a price toppingout. Based on the latest price actions – provided the USD59.00 level is not breached – our positive trading bias should stay intact.

We recommend traders stay in long positions. We initiated these at USD49.93, or the closing level of 5 Jan. To manage risks, the stop-loss is adjusted downwards, to below USD59.00.

Support levels are revised to USD60.00 and USD59.00, while the immediate resistance maintained at USD62.26 – the high of 18 Feb – followed by USD65.00.

Source: RHB Securities Research - 24 Feb 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024