FKLI - Placing Trailing-Stop At Breakeven Point

rhboskres

Publish date: Thu, 25 Feb 2021, 05:09 PM

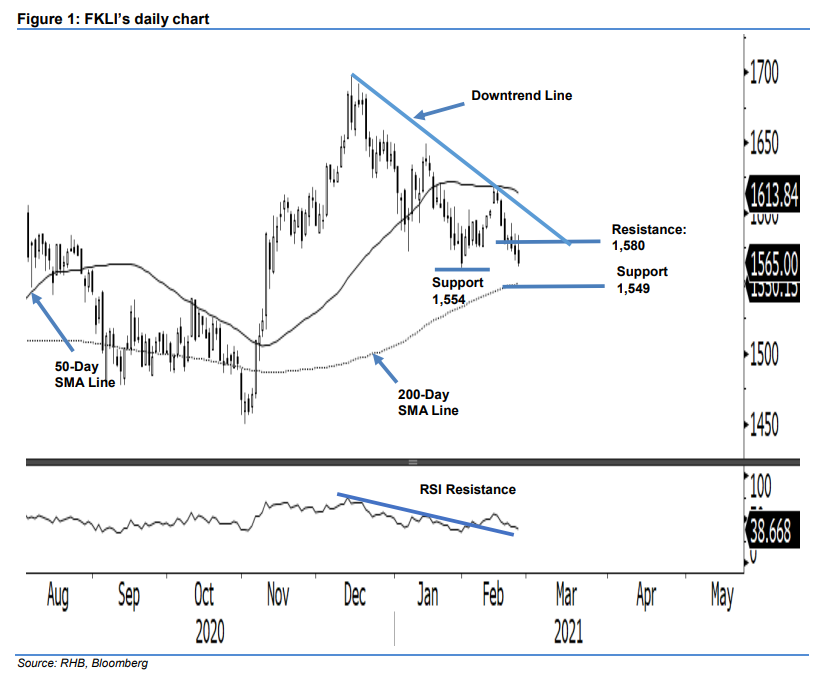

Maintain short positions. The FKLI underwent selling pressure in the second half of yesterday’s trading session, repeating the pattern set in previous days. After hitting a high of 1,584 pts, the index slid to a low of 1,561 pts, before closing 6 pts weaker at 1,565 pts. Note that the cash index, ie FBM KLCI (closing at 1,557.5 pts) retracement from Dec 2020’s high has reached a fresh low in the latest session (and not matched by the trading of futures), and is coming close to the 200-day SMA line. The futures contract’s premium suggests market participants are positioning for a possible end to the multi-week correction phase, reversing the trend towards the upside. Pending a positive followthrough in the coming sessions that would validate this possibility, we maintain a negative trading bias but are tightening up risk management.

We recommend that traders stay in short positions. We initiated these at 1,579 pts, the closing level of 18 Feb. To manage risks, a stop-loss can be placed at the breakeven mark.

The support levels are maintained at 1,554 pts – the low of 29 Jan – followed by 1,549 pts, which is at the 200-SMA line level. Meanwhile, the immediate resistance is set at 1,570 pts, followed by 1,580 pts.

Source: RHB Securities Research - 25 Feb 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024