FCPO - Negative Intraday Price Reversal

rhboskres

Publish date: Thu, 25 Feb 2021, 05:10 PM

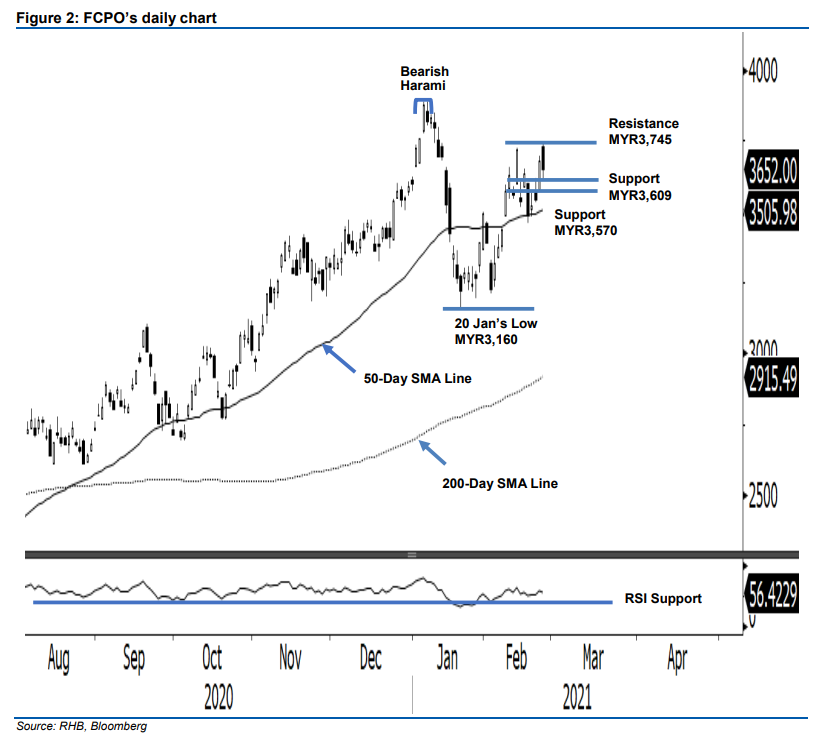

Maintain long positions while moving up trailling-stop. The FCPO underwent a sharp negative intraday price reversal, after it briefly crossed above the recent high of MYR3,720 with a high of MYR3,745 in the early part of the session. From the high point, it slid to a low of MYR3,609, before closing MYR24.00 lower at MYR3,652. The sharp price reversal can be regarded as a warning sign of the commodity’s advancement, as it indicates a possible price rejection. Towards the downside, if it closes below MYR3,570, this would likely open the door for a deeper correction phase to set in. Until this happens, we are keeping a positive trading bias.

We recommend that traders remain in long positions. We initiated these at MYR3,317, the closing level of 4 Feb. To manage risks, a stop-loss can now be placed below MYR3,570.

The support levels are revised to MYR3,609 and MYR3,570. Towards the upside, resistance points are now marked at MYR3,700, followed by MYR3,745 – the latest high.

Source: RHB Securities Research - 25 Feb 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024