E-Mini Dow - Breaking Out From the Sideways Trading Zone

rhboskres

Publish date: Thu, 25 Feb 2021, 05:11 PM

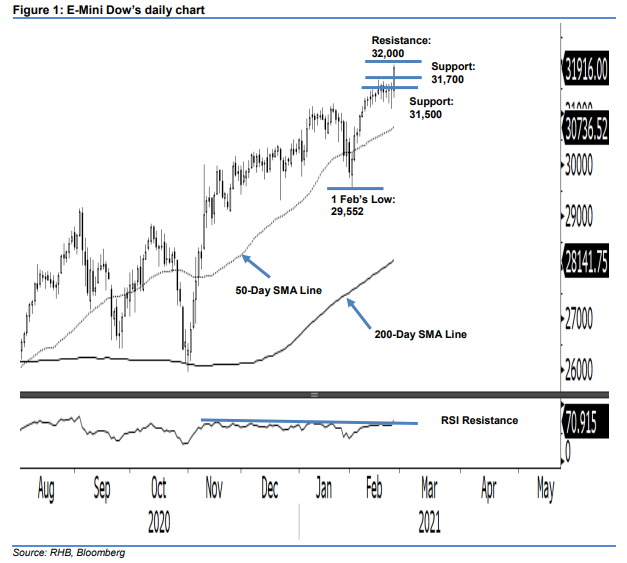

Maintain long positions, while placing the trailing-stop at the breakeven point. After consolidating in a sideways pattern over the last three weeks, the E-Mini Dow finally broke out from the 31,100-31,500-pt zone, to resume its long-term uptrend. After trading in a narrow and directionless fashion, the index found its footing during the US trading hours, moving to a high of 31,964 pts, before closing 424 pts higher at 31,916 pts. While the RSI is flashing out overbought readings, it has marginally crossed above the resistance line (as drawn in the chart) – indicating that momentum is still strong. Until signs of price exhaustion appear, we are keeping our positive trading bias.

We recommend traders stay in long positions, which were initiated at 30,950 pts, or the closing level of 4 Feb. For risk management purposes, a stop-loss can now be set at the breakeven point.

Support levels are revised to 31,700 pts and 31,500 pts. On the upside, the immediate resistance is at the 32,000- pt round figure, followed by 32,500 pts.

Source: RHB Securities Research - 25 Feb 2021