WTI Crude - Still Full of Energy

rhboskres

Publish date: Thu, 25 Feb 2021, 05:12 PM

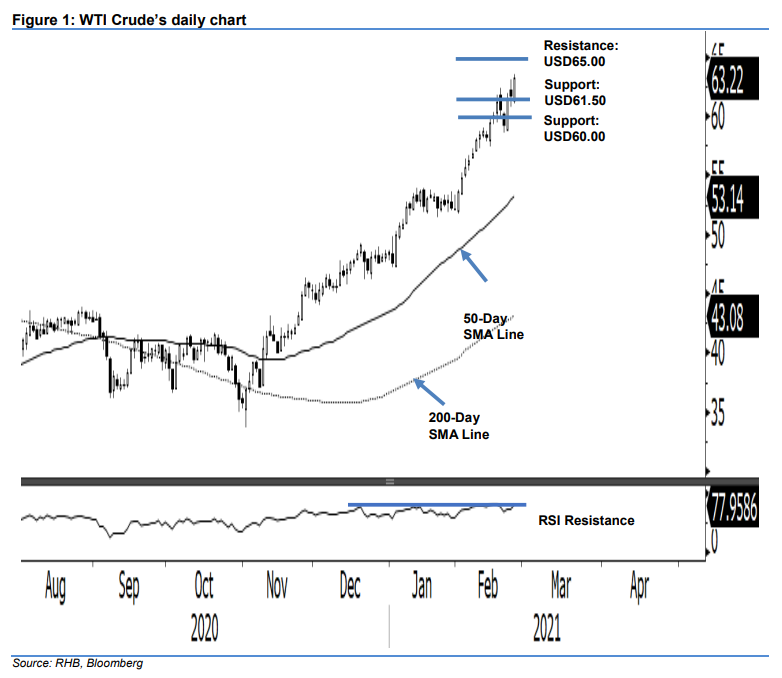

Maintain long positions, while moving the trailing-stop further up. The WTI Crude continued to march higher. The intraday trading tone was positive, as the commodity generally scaled higher without many obstacles. It settled USD1.55 higher at USD63.22 – not too far from the high of USD63.51. Recall that the commodity completed a quick correction on 18-19 Feb, as it attempted to overcome the USD60.00 round figure. While we continue to highlight the overbought condition, the latest price action did not signal price exhaustion. Towards the downside, we believe the USD60.00 threshold is now acting as a crucial support level. If it is breached southwards, the risk of a correction phase setting in would be high. Towards the upside, the area around USD65.00, which was the high point of 2020, is acting as a strong resistance threshold. For now, we are keeping our positive trading bias.

We recommend traders stay in long positions. We initiated these at USD49.93, or the closing level of 5 Jan. To manage risks, the stop-loss can now be placed below USD60.00

Support levels are revised to USD61.50 and USD60.00. Meanwhile the immediate resistance is revised to USD65.00, followed by USD67.00

Source: RHB Securities Research - 25 Feb 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024