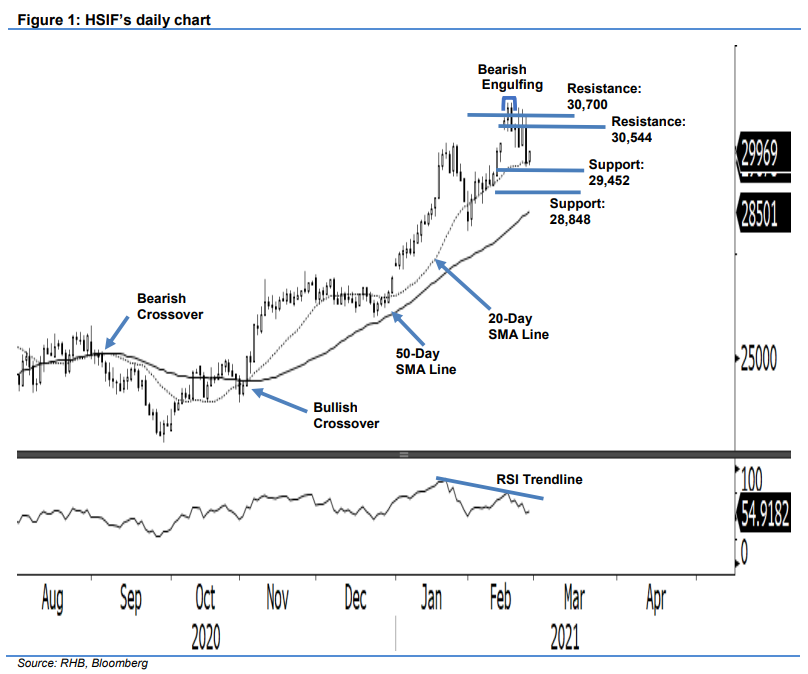

Hang Seng Index Futures - Retracing Lower Towards the 20-Day SMA Line

rhboskres

Publish date: Thu, 25 Feb 2021, 05:13 PM

Maintain short positions. The HSIF failed to hold on to the previous session’s gains, plunging 887 pts towards the 20-day SMA line to settle at 29,696 pts. Yesterday, the index gapped up 131 pts to start at 30,601 pts. Despite the strong opening, sentiment turned jittery during midday, with selling pressure dragging it towards the day’s low of 29,562 pts. The index pared losses during the evening session, to close at 29,969 pts after rebounding from the 29,597-pt session low. The average trading range (ATR) over the last 10 sessions rose further to 414 pts. As the index is approaching the month-end futures contract expiry, we expect volatility ahead. A breach below the 29,000-pt psychological level will see the index retrace towards the 50-day SMA line. A jump above the resistance level will see the resumption of the uptrend. Until it crosses the stop-loss level, we are keeping our negative trading bias.

We recommend traders stick to the short positions initiated at 30,077 pts – the closing level of 22 Feb. For risk management, the stop-loss is lowered to 30,544 pts.

The immediate support is marked at 29,452 pts, followed by 28,848 pts. Towards the upside, the immediate resistance is seen at 30,544 pts, followed by 30,700 pts.

Source: RHB Securities Research - 25 Feb 2021