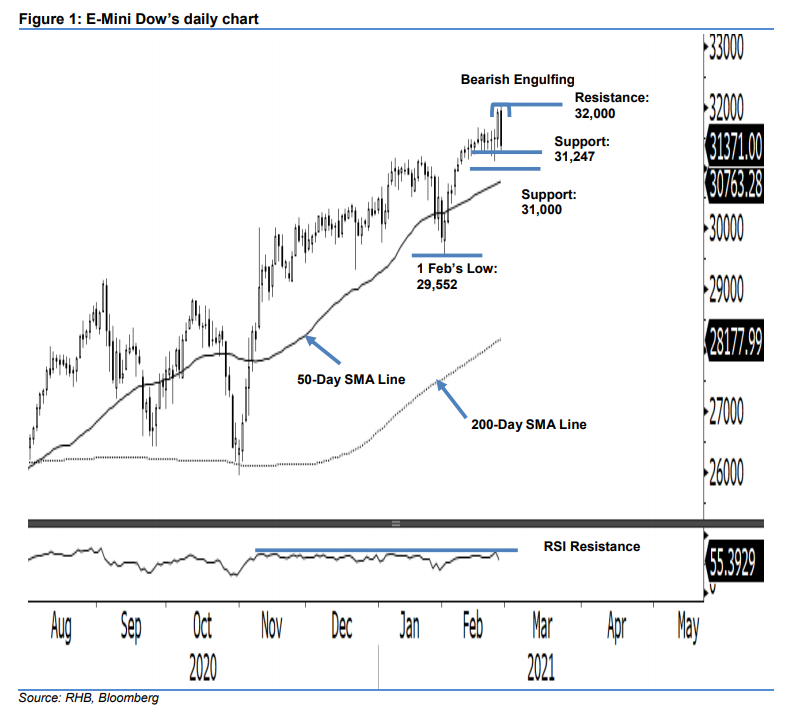

E-Mini Dow - Bearish Engulfing Appears

rhboskres

Publish date: Fri, 26 Feb 2021, 05:33 PM

Maintain long positions. The E-Mini Dow saw selling pressure on the back of the US Treasury’s spike. Earlier, the index briefly tested the 32,000-pt level, with a high of 32,033 pts. However, entering the US trading hours, it started to trend lower, hitting a low of 31,247 pts, before closing at 31,371 pts – representing a 454-pt decline. Consequently, the index fell into the 31,100-31,500-pt zone again, indicating that the previous session’s breakout could have been false. Also, a “Bearish Engulfing” has appeared. Should there be negative price follow-through in the coming sessions – such as a downside breach of 31,000 pts – the risk of developing a deeper correction may set in. Until then, we keep our positive trading bias.

We recommend traders stay in long positions, which were initiated at 30,950 pts, or the closing level of 4 Feb. For risk management purposes, a stop-loss can now be set at the breakeven point.

Support levels are revised to 31,247 pts – the latest low – and the 31,000-pt round figure. On the upside, the immediate resistance is pegged at 31,600 pts, followed by 32,000 pts.

Source: RHB Securities Research - 26 Feb 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024