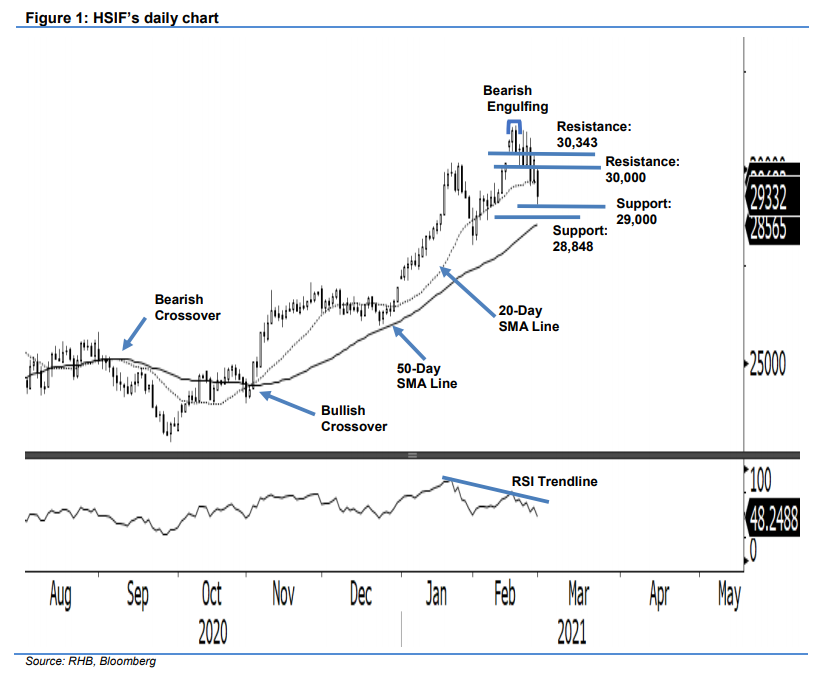

Hang Seng Index Futures - Struggling Near the 20-Day SMA Line

rhboskres

Publish date: Fri, 26 Feb 2021, 05:34 PM

Maintain short positions. The HSIF’s Feb 2021 futures contract settled at 30,219 pts, after rising 523 pts yesterday. The index opened flat at 30,062 pts, and rose to the day’s high of 30,343 pts. However, the rebound did not manage to breach the previous resistance level of 30,544 pts, and printed another “lower high” session. In the evening, selling pressure emerged, dragging Mar 2021 futures contract prices to close at 29,455 pts – a level near the session’s low of 29,443 pts. If the index fails to defend and stay on the 20-day SMA line in coming sessions, it will likely trend lower to the next support level near 29,000 pts and 28,848 pts –near the 50-day SMA line. The index needs to breach the nearest resistance of 30,343 pts to resume the uptrend. Until the index forms an interim low near the support level, we will keep our negative trading bias.

We recommend traders maintain the short positions initiated at 30,077 pts or the closing level of 22 Feb. For risk management, the stop-loss is placed at 30,343 pts.

The immediate support is marked at the 29,000-pt round figure, followed by 28,848 pts. Towards the upside, the immediate resistance is pegged at the 30,000-pt psychological level, followed by 30,343 pts.

Source: RHB Securities Research - 26 Feb 2021