WTI Crude - Holding Up Well

rhboskres

Publish date: Fri, 26 Feb 2021, 05:35 PM

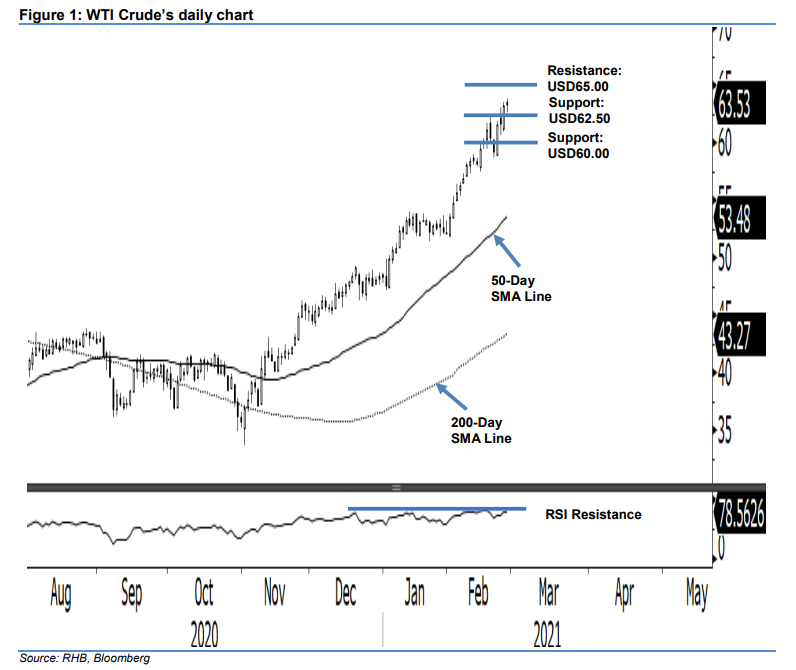

Maintain long positions. The WTI Crude weathered through the cross-assets’ risk-off session on a strong footing – indicating that its positive trend is still strong – despite the recent weeks’ sharp rally, which pushed the RSI into the overbought threshold. During the day, the commodity reached its high of USD61.81 during the European trading hours, before showing signs of developing a minor consolidation and settling USD0.31 higher at USD63.53. Looking at the price actions, chances are high that the commodity will extend its minor consolidation for a good part of today’s session. Towards the downside, USD60.00 will remain the crucial near-term support level. For now, we are keeping our positive trading bias.

We recommend traders stay in long positions. We initiated these at USD49.93, or the closing level of 5 Jan. To manage risks, the stop-loss can now be placed below USD60.00.

Support levels are revised to USD62.50 and USD60.00. On the upside, the immediate resistance is maintained at USD65.00, followed by USD67.00.

Source: RHB Securities Research - 26 Feb 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024