FKLI - Counter-Trend Rebound Still Possible

rhboskres

Publish date: Mon, 01 Mar 2021, 09:29 AM

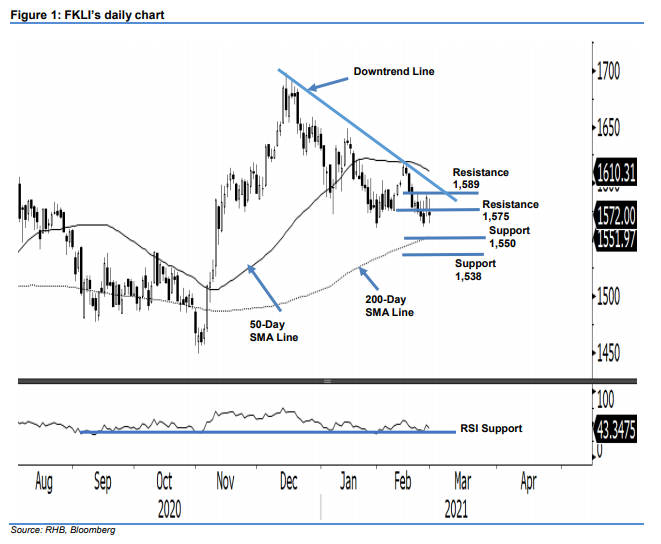

Maintain long positions. The FKLI tracked the overnight bearish sentiment of US peers, falling 15.50 pts to close at 1,572 pts last Friday. It gapped lower to open at 1,574.50 pts, then rebounded towards the session’s high of 1,586.50 pts. In the afternoon, the bears dragged the index towards the session’s low of 1,564.50 pts, before paring down losses and closing at just 2 pts above our stop-loss. Although the index saw heavy selling pressure, it did not form a “lower low” pattern, indicating there was bullish pressure supporting the index. As the RSI indicator is dipping towards the oversold level, we will not dismiss the possibility the index might undergo a technical rebound in coming sessions. As long as the stop-loss level stays intact, the bulls should not give up yet – and the index is still in the early stages of developing a counter-trend rebound. As such, we are keeping to our positive trading bias.

We recommend that traders stay in long positions. We initiated these at 1,587.50 pts, or the closing level of 25 Feb. To manage risks, a stop-loss can be set at 1,570 pts.

The support levels are revised to 1,550 pts, followed by 1,538 pts. Meanwhile, resistance points are marked at 8 Feb’s low of 1,575 pts, followed by 1,589 pts.

Source: RHB Securities Research - 1 Mar 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024