FCPO - Mild Profit-Taking

rhboskres

Publish date: Mon, 01 Mar 2021, 09:30 AM

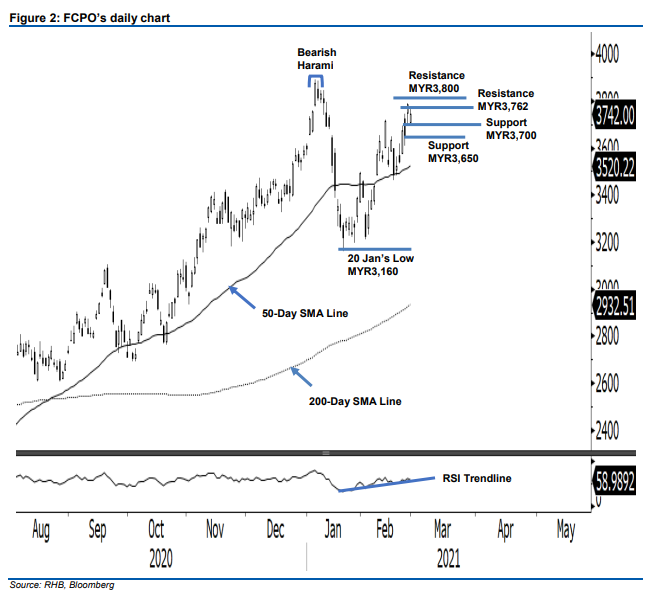

Maintain long positions. The FCPO saw mild profit-taking last Friday, retracing MYR42.00 to close at MYR3,742. The commodity gapped down by MYR76.00 when it opened at MYR3,708. It recorded a high of MYR3,762 and low of MYR3,703 for the day. Overall the uptrend structure remains intacts as the commodity still exhibiting a series of “higher highs” and “higher lows”. Coupled with 50-day SMA line is curving higher, we think the uptrend will resume once the profit taking activity is over. If the current retracement however extended and breach below the significant level of MYR3,600, we may see a possible of pullback towards 50-day SMA line or deeper corrections. As long as trailing-stop level stays intact, we are maintaining a positive trading bias.

We recommend that traders remain in long positions. We initiated these at MYR3,317, the closing level of 4 Feb. To manage risks, a trailing-stop can now be placed below MYR3,600.

The support levels are revised to MYR3,700, followed by MYR3,650. Towards the upside, the immediate resistance is now pegged at 26 Feb’s high of MYR3,762, followed by round figure MYR3,800.

Source: RHB Securities Research - 1 Mar 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024