WTI Crude - Within the Likely “Ending Diagonal” Structure

rhboskres

Publish date: Tue, 02 Mar 2021, 09:15 AM

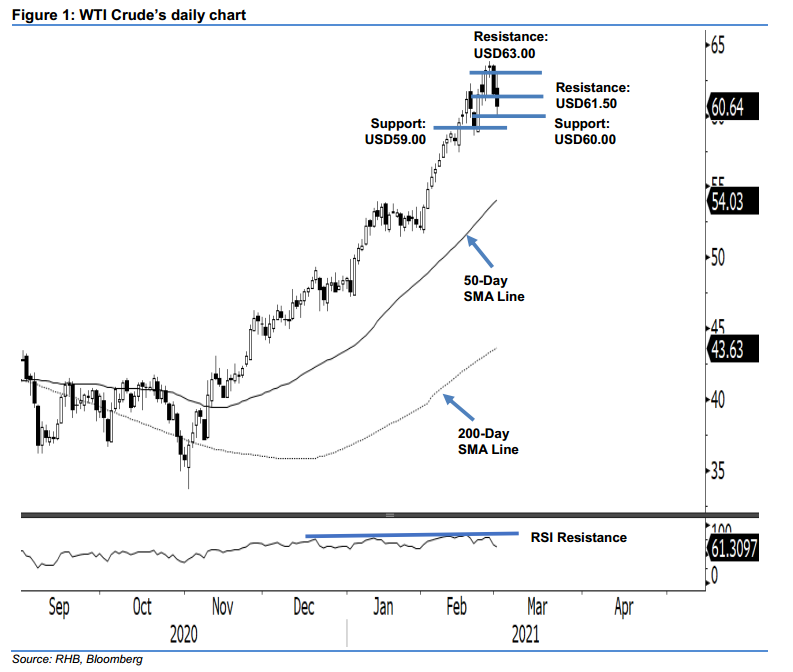

Maintain long positions. The WTI Crude failed to sustain its earlier session’s positive movement, which saw prices hitting a high of USD62,92 during the early part of the Asian trading hours. It consistently slid lower for the remaining part of the session, to end USD0.86 weaker at USD60.64. The low was posted at USD59.96. The extension of the retracement was in line with our forecast that the commodity is trading in an incomplete “Ending Diagonal” structure. The main characteristic of this structure is that while prices should continue trending higher, the pullback along this upward move will also be steep – as the commodity is currently experiencing. We maintain our positive trading bias.

We recommend traders stay in long positions. We initiated these at USD49.93, or the closing level of 5 Jan. To manage risks, the stop-loss can now be placed below USD59.00.

Support levels are maintained at USD60.00, followed by USD59.00. On the upside, the immediate resistance is now set at USD61.50, followed by USD63.00.

Source: RHB Securities Research - 2 Mar 2021