FKLI - Downside Risks Arise

rhboskres

Publish date: Tue, 02 Mar 2021, 09:22 AM

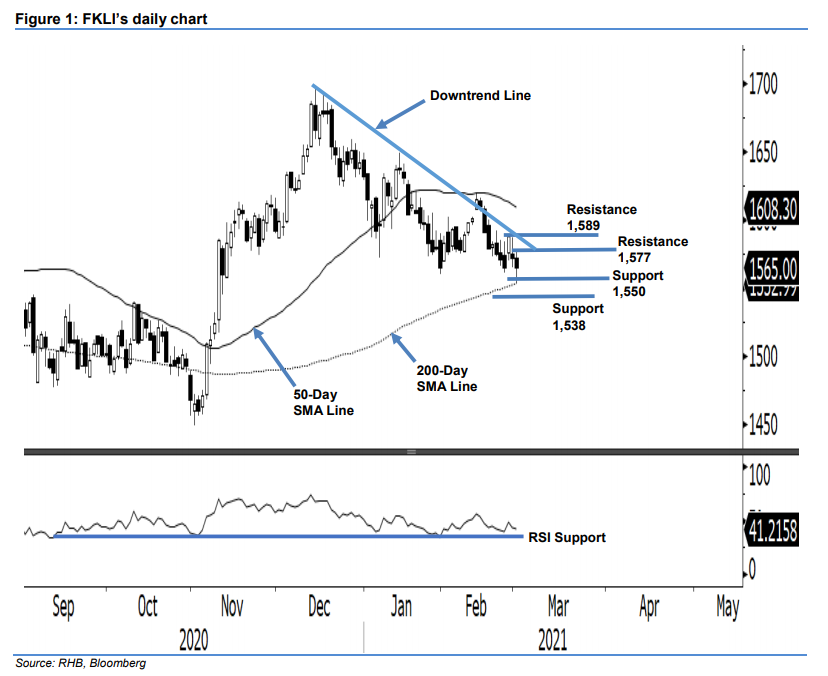

Stop loss triggered; initiate short positions. The FKLI is lagging behind regional peers, declining 1.00 pts to close at 1,565 pts. On Monday morning, the index was tracking such peers’ bullish sentiment and gapped higher to open at 1,572 pts – touching the 1,577-pt day high. Despite the session’s positive start, sentiment turned nervous during midday, which saw the FKLI falling to the session low of 1,553 pts. It last traded at 1,565 pts – breaching the stop-loss level. While selling pressure was witnessed throughout most of the session, mild buying pressure emerged near the 200-day SMA line. If the moving average gives way, the next lower support will be at 1,538 pts. The overhead 50-day SMA line is also turning lower, and we believe the index may face persistent selling pressure in the coming sessions. Since it is reverting to a downtrend movement, coupled with negative momentum, we shift to a negative trading bias.

We closed out the long positions that were initiated at 1,587.50 pts, or the closing level of 25 Feb. Conversely, we initiate short positions at 1 Mar’s closing level. To manage risks, a stop loss can be set at 25 Feb’s high of 1,589 pts.

The support levels are maintained at 1,550 pts and 1,538 pts. The resistance points are marked at 1 Mar’s high of 1,577 pts and followed by 1,589 pts.

Source: RHB Securities Research - 2 Mar 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024