Hang Seng Index Futures - Consolidating Sideways

rhboskres

Publish date: Wed, 03 Mar 2021, 06:33 PM

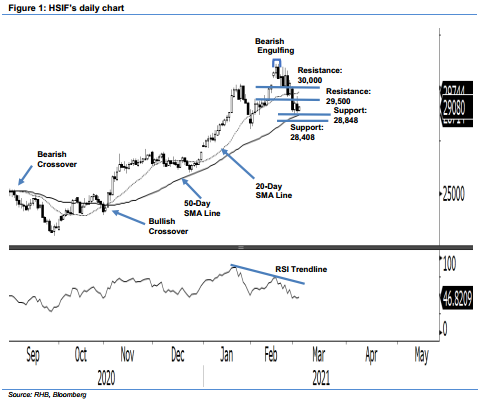

Maintain short positions. The HSIF was seen as consolidating sideways before making its new move. It retreated 325 pts yesterday to settle at 28,929 pts. After a strong opening at 29,519 pts, it tested the intraday high of 29,593 pts. However, the momentum faltered during midday and saw the index retracing to the 28,781-pt day low before closing at 28,929 pts. During the evening session, it recouped 151 pts to close at 29,080 pts. Looking at the RSI indicator – which is hovering below the 50% level (indicating a weak momentum ahead) – the HSIF may continue to be range-bound in-between the 29,500-pt resistance level and support level of 28,848 pts. With the recent consolidation movement, we see this as an interim consolidation within the correction phase that started since the Bearish Engulfing pattern. Without a bullish reversal pattern, the downward movement is not complete yet and tends to extend lower post consolidations. Unless the trailing stop is breached, we are keeping to our negative trading bias.

We recommend traders maintain short positions, which were initiated at 30,077 pts, or the closing level of 22 Feb. For risk-management purposes, the trailing stop is set at 29,700 pts.

The immediate support is unchanged at 28,848 pts, followed by 28,408 pts. Towards the upside, the immediate resistance remains at the 29,500-pt round figure and followed by the 30,000-pt psychological level.

Source: RHB Securities Research - 3 Mar 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024