WTI Crude - Slightly Below the USD60.00 Mark

rhboskres

Publish date: Wed, 03 Mar 2021, 08:51 AM

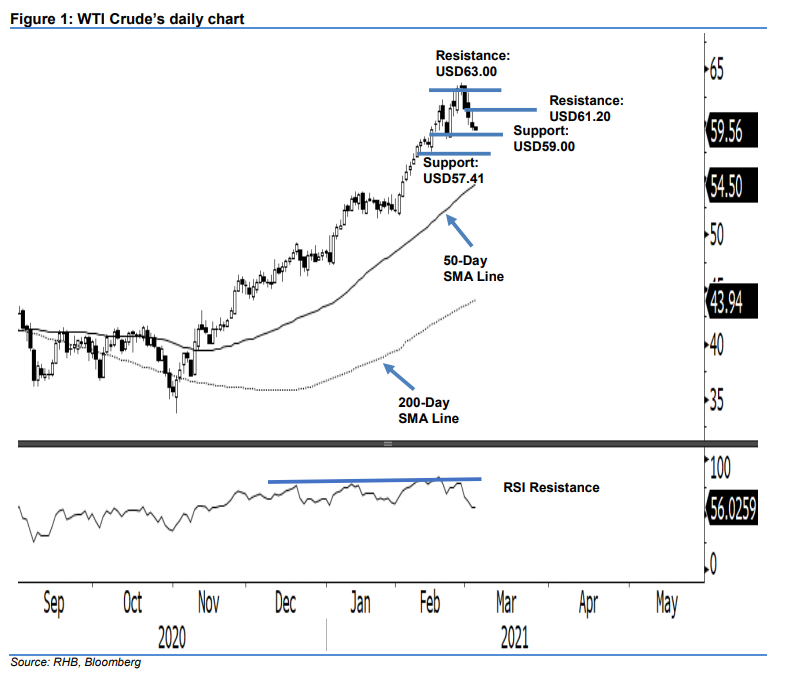

Maintain long positions. The WTI Crude’s attempt to stage a rebound was foiled when sellers emerged during the US trading hours. Consequently, the black gold was hammered down from a USD61.21 high to a low of USD59.38 before closing at USD59.75 – representing a USD0.89 drop. Based on our expectation that the commodity is developing an “Ending Diagonal” price pattern, a positive price reversal should be happening in the coming sessions – this could see the WTI Crude retesting its recent high of USD63.81. Alternatively, if the USD59.00 level is breached at the close, the “Ending Diagonal” thesis will be invalidated and a deeper retracement may develop. For now, we are keeping to our positive trading bias.

We recommend traders stay in long positions. We initiated these at USD49.93, or the closing level of 5 Jan. To manage risks, the stop loss can now be placed below USD59.00.

Support levels are revised to USD59.00 and USD57.41 – the latter is the low of 12 Feb. Moving up, the immediate resistance is revised to USD61.20 – near the latest high – and followed by USD63.00.

Source: RHB Securities Research - 3 Mar 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024