WTI Crude - Price Reversal Signal Appears

rhboskres

Publish date: Thu, 04 Mar 2021, 06:44 PM

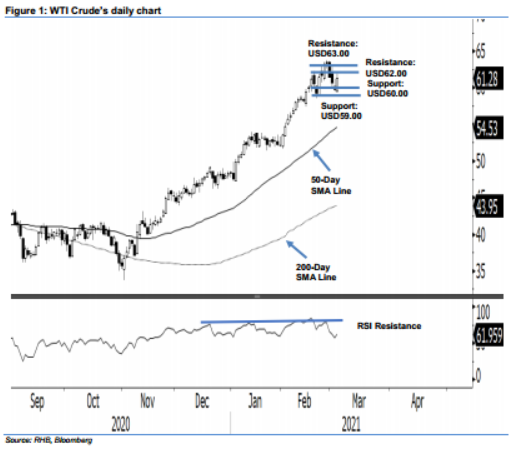

Maintain long positions. After a soft opening, which saw prices dip to a low of USD59.24, the WTI Crude generally trended higher for the rest of the session, reaching a high of USD61.99, before closing USD1.53 stronger at USD61.28. A positive price reversal “Bullish Engulfing” formation has also appeared. The positive performance is in line with our expectation for the black gold to resume its upward charge, within the potential “Ending Diagonal” price pattern. Towards the upside, we expect prices to swing towards the recent high of around USD63.00 in a relatively choppy manner – a key characteristic of the “Ending Diagonal” pattern. We keep our positive trading bias.

We recommend traders stay in long positions. We initiated these at USD49.93, or the closing level of 5 Jan. To manage risks, the stop-loss can now be placed below USD59.00.

Support levels are revised to the USD60.00 round figure, followed by USD59.00. On the upside, the immediate resistance is revised to USD62.00, followed by USD63.00.

Source: RHB Securities Research - 4 Mar 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024