WTI Crude - Trending Upwards in a Volatile Pattern

rhboskres

Publish date: Fri, 05 Mar 2021, 06:01 PM

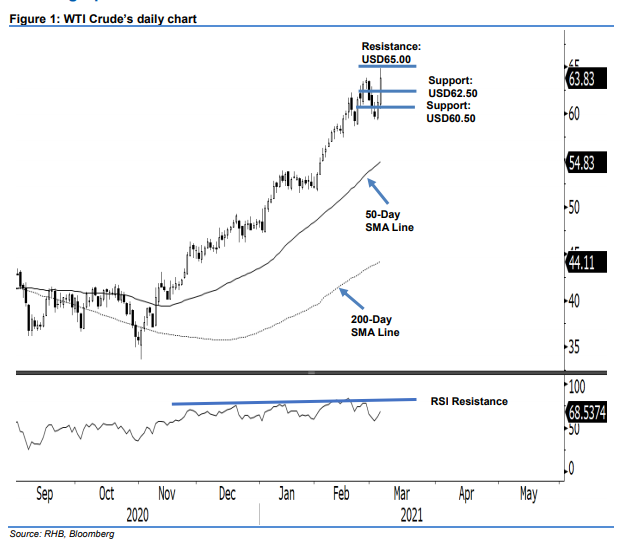

Maintain long positions. The WTI Crude had a volatile session. After developing a lower timeframe consolidation during the Asian and European trading hours, which saw the commodity slip to a low of USD60.52.On positive newsflow, it spiked to a high of USD64.86 before closing at USD63.83 – a USD2.55 gain. Looking at the possible “Ending Diagonal” price pattern, which we believe has yet to reach completion, the commodity is likely to develop a pullback in the coming sessions, before resuming its upward charge. Overall, we keep our positive trading bias.

We recommend traders stay in long positions. We initiated these at USD49.93, or the closing level of 5 Jan. To manage risks, the stop-loss can now be placed below USD59.00.

Support levels are revised to USD62.50, followed by USD60.50. On the upside, the immediate resistance is pegged at USD65.00, followed by USD67.00.

Source: RHB Securities Research - 5 Mar 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024