E-Mini Dow - Possibly Still a Minor Correction

rhboskres

Publish date: Fri, 05 Mar 2021, 06:05 PM

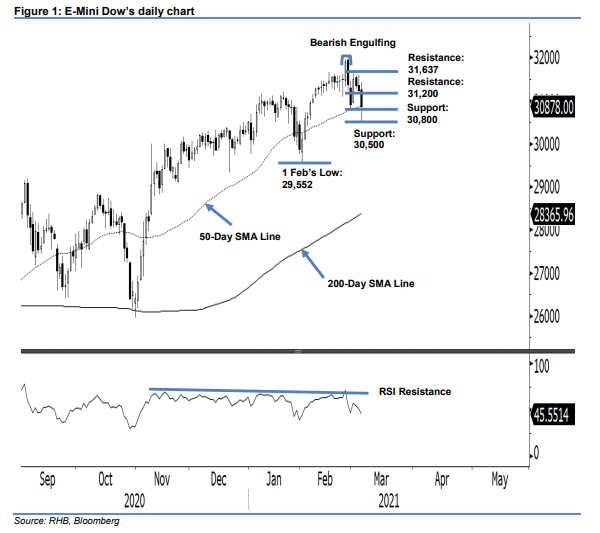

Maintain long positions, as the index may be developing a narrow A-B-C corrective pattern. The E-Mini Dow extended its correction yesterday. It reached a low of 30,512 pts before narrowing its losses to 358 pts, and closing at 30,878 pts – marginally above the 50-day SMA line. The ability of the said SMA line to hold at the closing, indicates that the index’s risk of developing a deeper correction phase is still contained. Looking at the price pattern so far, there is a good chance that the correction phase – which started from 25 Feb’s “Bearish Engulfing” – is taking the shape of a classic A-B-C corrective pattern. This implies a possibility that the index’s narrow correction phase has ended. We maintain our positive trading bias.

We recommend traders stay in long positons. We initiated these at 31,509 pts, or the closing level of 1 Mar. For risk management purposes, a stop-loss can be placed below 30,800 pts.

Support levels are revised to 30,800 pts – near the 50-day SMA line – followed by 30,500 pts, which is near the latest low. On the upside, the immediate resistance is pegged at 31,200 pts, followed by 31,637 pts – derived from 1 Mar’s high.

Source: RHB Securities Research - 5 Mar 2021