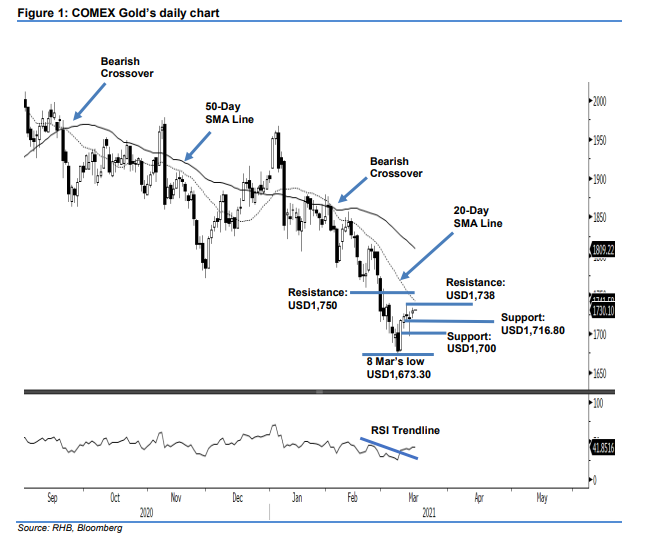

COMEX Gold - Attempting to Test the 20-Day SMA Line

rhboskres

Publish date: Tue, 16 Mar 2021, 08:53 AM

Trailing-stop triggered; Initiate long positions. The COMEX Gold saw mild buying interest, rebounding USD9.40 to settle at USD1,729.20. It gapped up USD6.70 to open at USD1,726.50, and found its footing near the session’s low of USD1,719.20. When the US trading hours started, the commodity fell from the high of USD1,733.20, but managed to recoup its losses to close at USD1,729.20, recording a positive session. Based on the last few sessions since 8 Mar’s low of USD1,673.30, the bullish momentum is strengthening and potentially extending towards the 20-day SMA line. Strong buying interest was also seen near USD1,700. As the USD1,729 level was breached, we shift to a positive trading bias to ride on the counter-trend rebound.

We closed out the short positions after the trailing-stop at USD1,729 was triggered. Conversely, we initiate long positions at the closing level of 15 Mar. For risk management purposes, the stop-loss is placed at USD1,700.

The immediate support is revised to 11 Mar’s low of USD1,716.80, followed by the USD1,700 psychological level. Towards the upside, the resistance is pegged at 11 Mar’s high of USD1,738, followed by the USD1,750 round figure.

Source: RHB Securities Research - 16 Mar 2021