WTI Crude - Averting a Deeper Correction for Now

rhboskres

Publish date: Tue, 16 Mar 2021, 08:57 AM

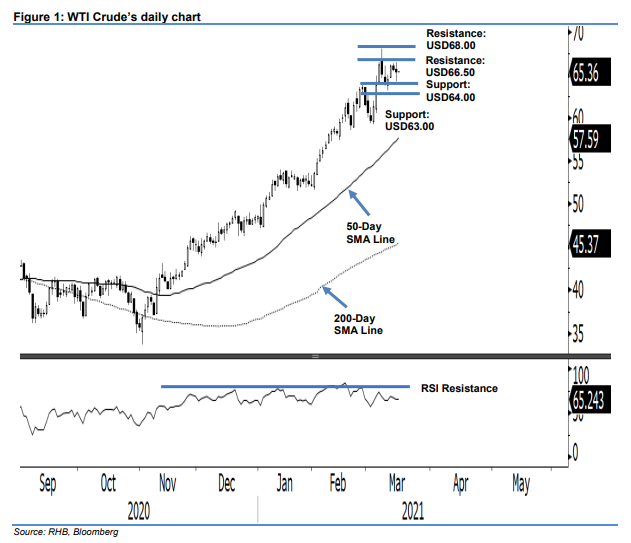

Maintain long positions. The WTI Crude experienced a rapid decline during the European trading hours, with prices briefly breaching below its previous session’s narrow sideways range. The low was posted at USD64.13 – not too far from the immediate support level of USD64.00. However, a re-appearance of bids saw the black gold narrowing its losses to USD0.22 to close at USD65.39. The positive price reaction from an area near the USD64.00 support level signals that the buyers remain in control, and the risk of a deeper and lengthy correction phase developing over the near-term remains contained for now. Overall, the multi-month uptrend is still firmly in place despite the pullback experienced early last week.

We recommend traders stay in long positions. We initiated these at USD49.93, or the closing level of 5 Jan. To manage risks, the stop-loss can now be placed below the USD64.00 threshold.

Support levels are pegged at USD64.00, followed by USD63.00. Conversely, resistance levels are set at USD66.50 and USD68.00.

Source: RHB Securities Research - 16 Mar 2021