Hang Seng Index Futures - Testing the 50-day SMA Line Again

rhboskres

Publish date: Wed, 17 Mar 2021, 05:46 PM

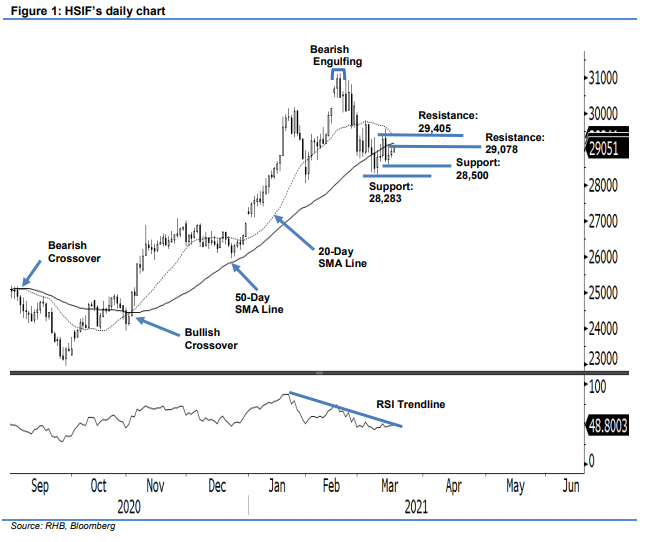

Keep to short positions. The HSIF saw back-to-back rebounds, adding 118 pts to settle at 28,954 pts. While it started the session stronger at 29,049 pts – touching a high of 29,117 pts – the index failed to retain the 29,000-pt level during the day session. It retraced to a low of 28,835 before settling at 28,954 pts. In the evening session, it rose to a high of 29,117 pts, and was last traded at 29,051 pts. The index is forming a consolidation base near the 29,000- pt level. As seen in the chart, this is crucial, now that the 20-day SMA line is about to cross below the 50-day SMA line. If the Bearish Crossover happens, the uptrend that started from the Bullish Crossover will come to an end. If the index manages to breach the upside resistance, and stay above both the 20- and 50-day SMA lines, the uptrend structure will be retained. Until the trailing-stop level is breached, we are keeping our negative trading bias.

We recommend traders keep to the short positions initiated at 30,077 pts, or the closing level of 22 Feb. For risk management purposes, the trailing-stop remains at 29,450 pts.

The support level is unchanged at 28,500 pts, followed by 9 March’s low of 28,283 pts. Towards the upside, the immediate resistance is pegged at 4 Mar’s close of 29,078 pts, followed by 11 Mar’s high of 29,405 pts.

Source: RHB Securities Research - 17 Mar 2021