WTI Crude - USD64.00: Increasingly Crucial Near-Term Support Level

rhboskres

Publish date: Wed, 17 Mar 2021, 05:47 PM

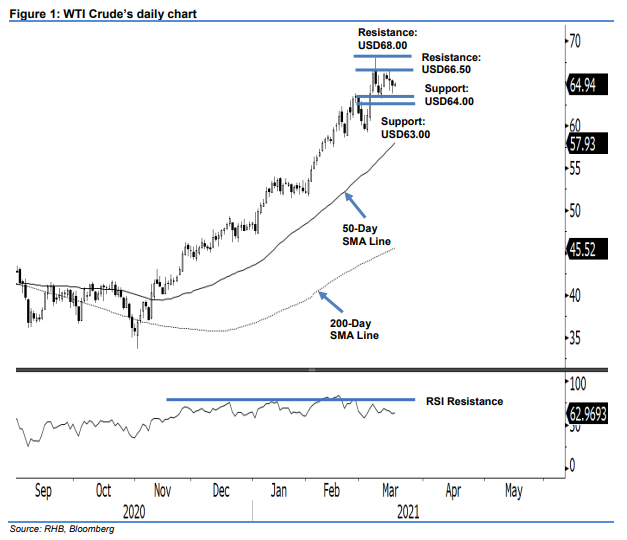

Maintain long positions. The WTI Crude repeated its prior session’s trading pattern of reversing to narrow intraday losses after reaching close to the USD64.00 support level. The latest session saw the commodity rebound from a low of USD63.80, before closing USD0.59 lower at USD64.80. The two most recent sessions’ price actions have further validated the importance of the said support level. Should prices fail to hold above this level, the possibility will be high for the black gold’s correction to become even deeper and lengthier – confirming that the multi-month upward move has reached its top. For now, we are keeping our positive trading bias.

We recommend traders stay in long positions. We initiated these at USD49.93, or the closing level of 5 Jan. To manage risks, the stop-loss can now be placed below the USD64.00 threshold.

Support levels remain at USD64.00, followed by USD63.00. On the upside, resistance levels are set at USD66.50 and USD68.00.

Source: RHB Securities Research - 17 Mar 2021