E-Mini Dow - Moving Up the Trailing-Stop Ahead of Key Event

rhboskres

Publish date: Wed, 17 Mar 2021, 05:48 PM

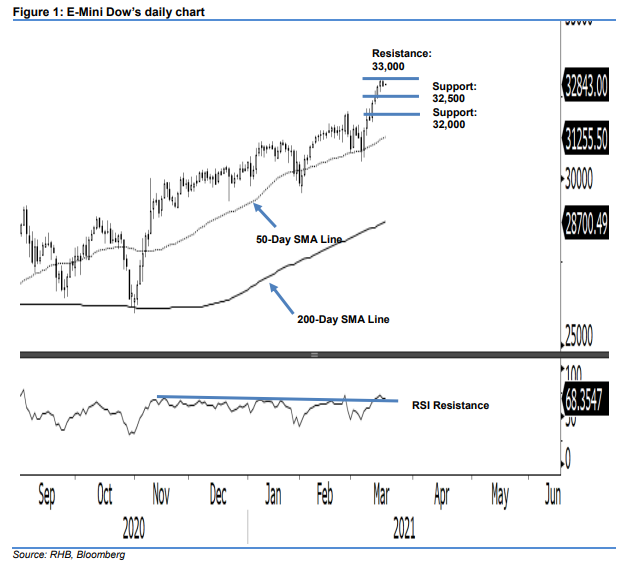

Maintain long positions. The E-Mini Dow’s latest session was unexciting, as it ended its seven consecutive wins to close 122 pts lower at 32,835 pts, on the back of a relatively narrow trading band of 32,773 – 32,972 pts. The index’s two most recent sessions’ price actions did not signal a price rejection from the 33,000-pt overhead resistance. The latest soft performance is likely a symptom of mild profit-taking, following the index’s two-week sharp rebound off the 50-day SMA line, which has accumulated gains of 2,460 pts. Ahead of the FOMC announcement today, it is advisable to tighten up risk management for our ongoing long positions. For now, we are keeping our positive trading bias.

We recommend traders stay in long positions. We initiated these at 31,509 pts, or the closing level of 1 Mar. For risk management purposes, a stop-loss can be placed below 32,000 pts.

Support levels are maintained at 32,500 pts, followed by 32,000 pts. On the upside, the immediate resistance is set at the 33,000-pt round figure, followed by 33,300 pts.

Source: RHB Securities Research - 17 Mar 2021