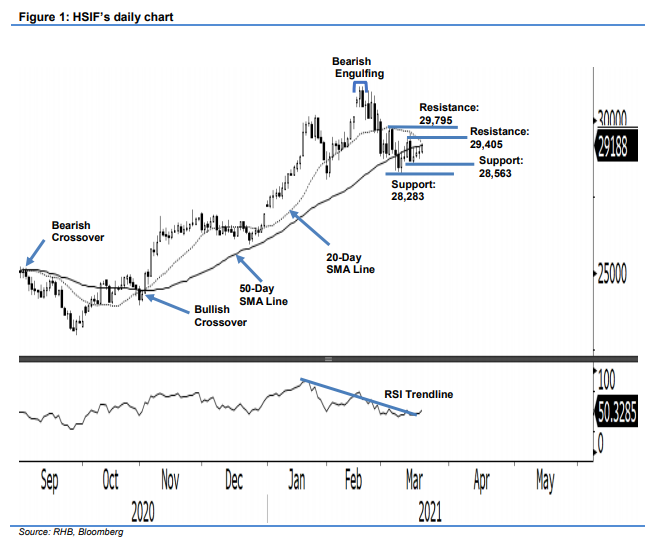

Hang Seng Index Futures - Attempting to Cross the 20-Day SMA Line

rhboskres

Publish date: Thu, 18 Mar 2021, 04:46 PM

Remains short positions. The HSIF saw mild buying interest yesterday, adding 37 pts to settle at 28,991 pts. It started the day’s session at 29,050 pts and climbed to the session’s high of 29,152 pts. The index then pared the gains and fell towards the session’s low 28,736 pts but saw selling pressure absorbed and rebounded to end the day at 28,991 pts. In the evening, after the FOMC decided to keep benchmark interest rates steady, the HSIF rose to the session’s high of 29,234 pts, and last traded at 29,188 pts. The RSI indicator managed to break above the downtrend line and crossed the 50% threshold, suggesting that the bullish momentum is gaining traction. If the index manages to cross the nearest resistance of 29,405 pts and stay above the 20-day SMA line, we expect to see an end of consolidation phase and resumption of an uptrend. Meanwhile, we keep to our negative trading bias.

We recommend traders keep to short positions initiated at 30,077 pts, or the closing level of 22 Feb. For risk management purposes, the trailing-stop is revised to 29,405 pts.

The support level is revised to 15 Mar’s low of 28,563 pts, followed by 9 March’s low of 28,283 pts. Towards the upside, the immediate resistance is pegged at 11 Mar’s high of 29,405 pts, followed by 3 Mar’s high of 29,795 pts.

Source: RHB Securities Research - 18 Mar 2021