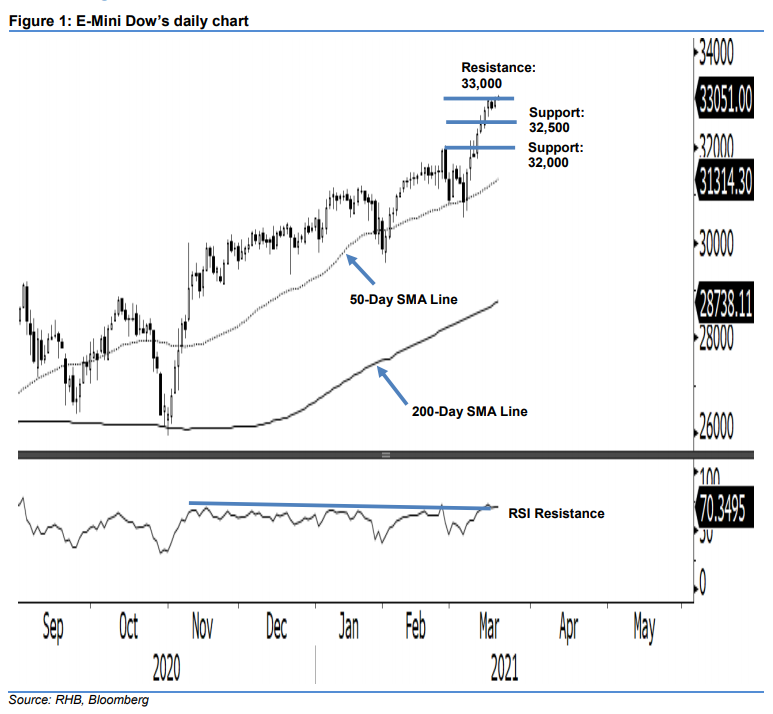

E-Mini Dow - Remaining Indecisive Above the 33,000-Pt Resistance

rhboskres

Publish date: Thu, 18 Mar 2021, 04:48 PM

Maintain long positions. As the market waited for the FOMC’s decision (released at 2am Malaysian time), the EMini Dow largely swung in a directionless pattern for most of the session. The index only found its footing post the release of the US Federal Reserve’s statement, and saw prices hitting a high of 33,053 pts before closing 182 pts higher at 33,017 pts – not a decisive breach of the 33,000-pt immediate resistance. The index has been testing the threshold in the latest three sessions. So far, there has been no price rejection signal spotted from the daily and lower time-frame charts, despite the slight overbought RSI readings. While price momentum has slowed down marginally after the recent sharp gains, in the absence of a negative price signal, we keep to our positive trading bias.

We recommend traders stay in long positions. We initiated these at 31,509 pts, or the closing level of 1 Mar. For risk management purposes, a stop-loss can be placed below 32,000 pts.

Support levels are maintained at 32,500 pts and 32,000 pts. Moving up, the immediate resistance is maintained at the round figure of 33,000 pts as it was not decisively breached, followed by 33,300 pts.

Source: RHB Securities Research - 18 Mar 2021