COMEX Gold - Counter-Trend Rebound Extends Further

rhboskres

Publish date: Wed, 07 Apr 2021, 04:38 PM

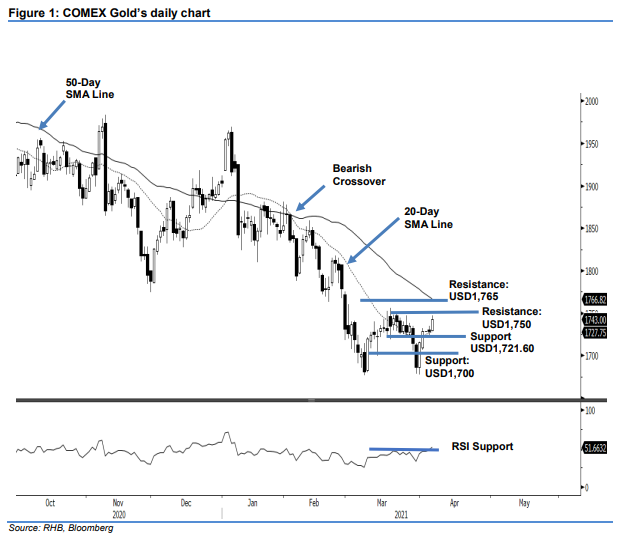

Maintain long positions. The COMEX Gold saw an extension of bullish momentum yesterday, rising USD14.20 to settle at USD1,743. The precious metal started at USD1,729.20 on Tuesday, and found its footing at the session’s low of USD1,728.20. Although it fell the low again – during the Asia trading hours – strong buying interest during the London trading hours lifted the precious metal to a high of USD1,746.70. Amidst strong buying pressure, it was last traded at USD1,743. Since the commodity crossed above the 20-day SMA line, the countertrend rebound has been moving in a “higher high” bullish pattern. Coupled with the RSI crossing above the 50% threshold, the rebound may extend towards the 50-day SMA line – or at least test the USD1,750 resistance level. Underpinned by bullish momentum, we maintain our positive trading bias.

We recommend traders keep to the long positions initiated at USD1,715.60 on 31 Mar. For risk management purposes, the stop-loss is raised to USD1,700.

The immediate support is revised to 5 Apr’s low of USD1,721.60, followed by USD1,700. Towards the upside, the nearest resistance is pegged at the USD1,750 round figure, followed by USD1,765.

Source: RHB Securities Research - 7 Apr 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024