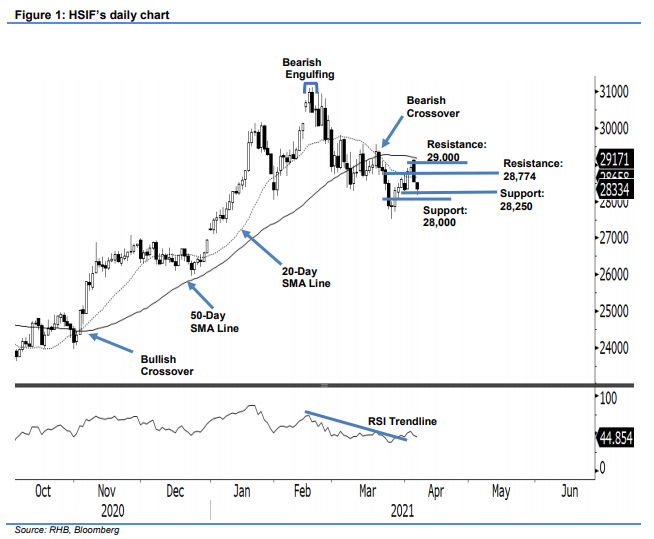

Hang Seng Index Futures - Falling Below the 20-Day SMA Line

rhboskres

Publish date: Thu, 08 Apr 2021, 04:40 PM

Maintain long positions. On the first trading session after a long holiday break, the HSIF saw bearish momentum emerging as it fell 276 pts to end the day session at 28,541 pts. The index had a strong start to yesterday’s day session, as it opened at 29,130 pts. After touching session high of 29,148 pts, it fell to the session low of 28,516 pts. During the evening session, the bearish momentum continued – the HSIF closed at 28,334 pts after testing the session high of 28,525 pts. After the index fell below the 20-day SMA line, there is a risk it may extend the correction and see the resumption of downward movements. Breaching the 28,000-pt psychological level will open the door for a deeper correction. Meanwhile, the previous counter-trend movement may resume if it climbs above the 20-day SMA line. Since the recent correction did not breach the stop loss, we stick to our positive trading bias.

We recommend traders remain in long positions, initiated at 28,385 pts, or the closing level of 29 Mar. For riskmanagement purposes, the stop loss is placed at 28,250 pts.

The immediate support is revised to 28,250 pts, followed by the 28,000-pt round figure. Towards the upside, the immediate resistance is revised to 31 Mar’s 28,774-pt high, followed by the next hurlde at the 29,000-pt round figure.

Source: RHB Securities Research - 8 Apr 2021