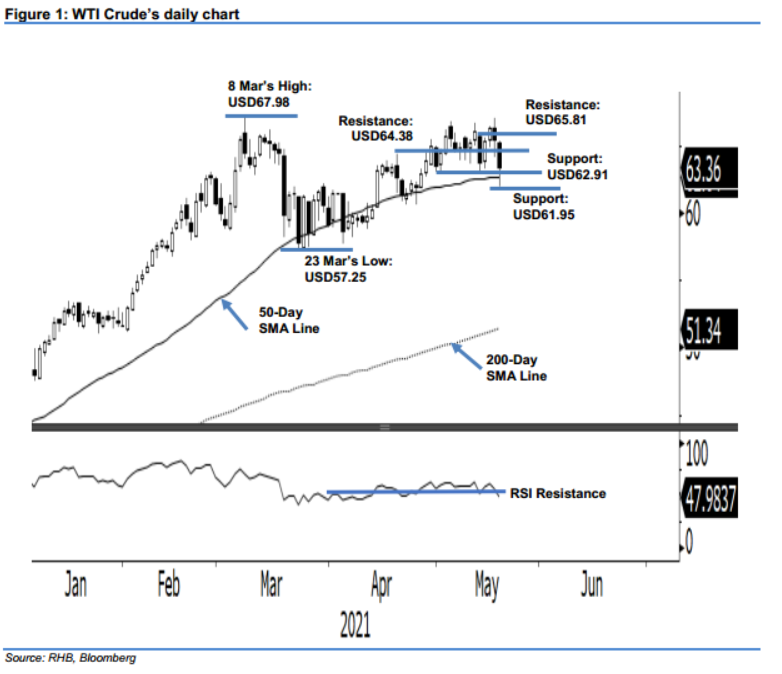

WTI Crude - Testing the 50-Day SMA Line

rhboskres

Publish date: Thu, 20 May 2021, 05:37 PM

Maintain short positions. The WTI Crude saw a massive correction, tumbling USD2.13 to settle at USD63.36 – forming a “lower low” bearish pattern. After failing to hold on to the USD66.00 level in the previous session, the commodity gapped down to start Wednesday’s session at USD65.28. Sentiment remained weak, sending the commodity towards the day’s low of USD61.95 before it pared its losses to close at USD63.36. Selling pressure was very strong, causing it to breach the previous support level of USD64.29. If selling pressure extends, the WTI Crude may retest the USD61.95 support level or May’s low. As the RSI has fallen below the 50% threshold – indicating negative momentum will continue – we hold on to our negative trading bias.

Traders should stick to the short positions initiated at USD63.82, or the closing level of 13 May. To manage risks, the initial stop-loss level is adjusted to USD65.50.

The nearest support is revised to USD62.91 – 3 May’s low – followed by USD61.95, or the low of 19 May. The immediate resistance is seen at USD64.38 or the high of 20 Apr, followed by USD65.81, which was 13 May’s high.

Source: RHB Securities Research - 20 May 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024