FKLI - Attempting To Breach The Immediate Support

rhboskres

Publish date: Thu, 20 May 2021, 05:37 PM

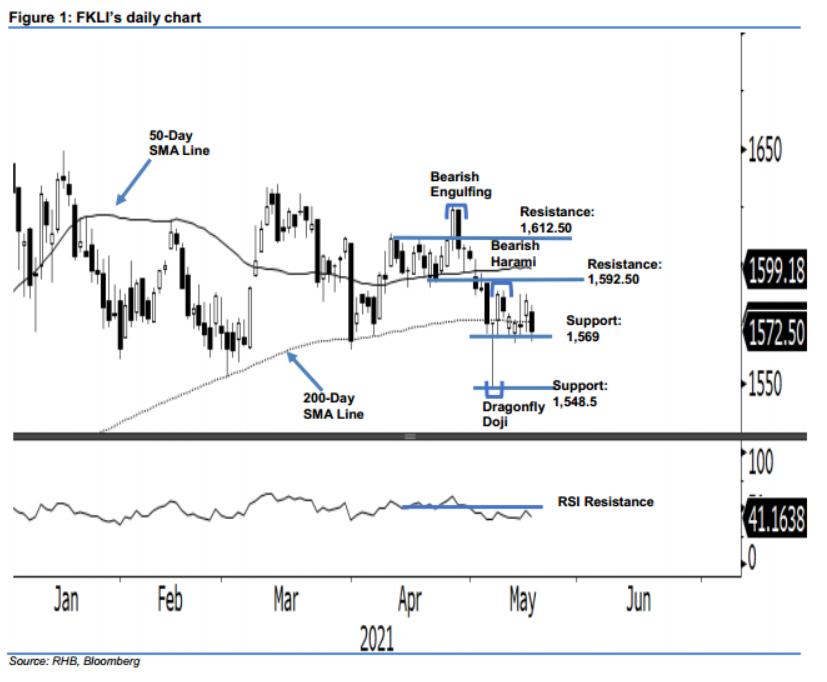

Maintain long positions. The FKLI failed to sustain above the 200-day SMA line again after it fell 12.5 pts near its immediate support level yesterday. The index opened weaker at 1,580.5 pts to tap the day’s high of 1,583 pts before it swiftly moved downwards towards the day’s low of 1,567.5 pts and bounced off mildly to close at 1,572.5 pts. The sharp decline yesterday writes off the bullish momentum that emerged the day before. Hence, the index is experiencing a neutral momentum above its support level. A bearish momentum could emerged if the index falls below the immediate support level, while the bulls may return if a long white candle is formed in the coming sessions. Since the index has yet close below the stop-loss level ie the immediate support, we stick to our positive trading bias.

Traders should remain in long positions. We initiated these at 1,588 pts, which was also the closing level of 7 May. To mitigate risks, the stop-loss is set below 1,569 pts, or 7 May’s low.

The support levels are maintained at 1,569 pts, which is 7 May’s low, and at 1,548.5 pts – 6 May’s low. Towards the upside, the resistance levels are unchanged at 1,592.50 pts – 5 May’s high, and 1,612.5 pts, or 30 Mar’s high.

Source: RHB Securities Research - 20 May 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024