FCPO - Struggling Near The MYR4,300 Level

rhboskres

Publish date: Thu, 20 May 2021, 05:40 PM

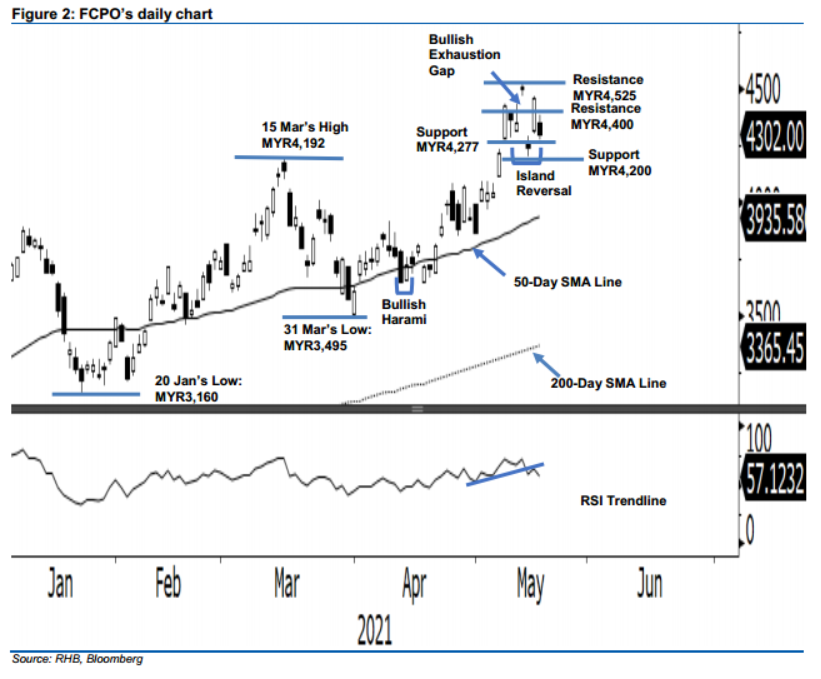

Maintain long positions. The FCPO retraced sharply with a gap down breaching below the previous support level to close MYR155 weaker yesterday. The commodity started the session with a gap down at MYR4,350, then oscillated between the day’s high of MYR4,380 and MYR4,271, which was the day’s low in a downward direction to close weaker at MYR4,302. The recent high volatility has caused the commodity to move in a whipsaw pattern, and we expect this to persist in the immediate sessions. The strong negative momentum yesterday, in normal conditions, was a cautious signal to traders towards the downward movement. However, we do not discount the possibility of the positive momentum being revived during this volatile period. Since the stop loss has yet to be triggered, we retain our positive trading bias.

We recommend traders to maintain long positions. We initiated these at the closing level of 18 May at MYR4,457. To manage risks, a stop loss can be located below the immediate support level of MYR4,277.

The immediate support level is revised at MYR4277 or 7 May’s low, followed by the psychologicial level of MYR4,200. Towards the upside, the resistance levels are revised at 12 May’s high of MYR4,400, and subsequently, MYR4,525 – 12 May’s high.

Source: RHB Securities Research - 20 May 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024