WTI Crude - Falling Below the 50-Day SMA Line

rhboskres

Publish date: Fri, 21 May 2021, 03:21 PM

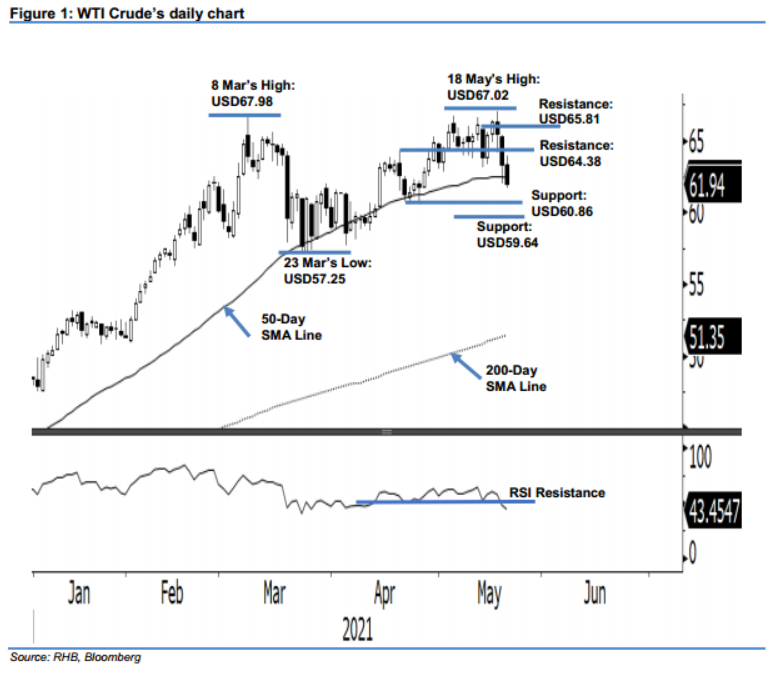

Maintain short positions. The WTI Crude saw an extension of the correction that started from the USD67.02 level, falling USD1.41 to settle at USD61.94. Following Wednesday’s bearish session, the commodity began Thursday’s session weaker at USD63.35. It initially moved sideways, attempting to test the day’s high of USD63.95. However, selling pressure emerged again during the European trading hours, dragging it towards the day’s low of USD61.67, before it closed at USD61.94 – recording a third consecutive negative session. As the RSI is pointing lower, the commodity may see the negative momentum follow through in coming sessions, forming another “lower low” bearish pattern. Meanwhile, we expect a technical rebound near USD60.86 before the commodity can test the USD60.00 psychological level. As the bears are still gripping the commodity, we keep our negative trading bias.

Traders should maintain the short positions initiated at USD63.82, or the closing level of 13 May. To manage risks, the stop-loss threshold is adjusted to USD65.35 or the high of 19 May.

The nearest support is revised to USD60.86 – 21 Apr’s low – followed by USD59.64, or the low of 13 Apr. The immediate resistance is seen at USD64.38 or the high of 20 Apr, followed by USD65.81, which was 13 May’s high.

Source: RHB Securities Research - 21 May 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024