FCPO - Negative Momentum Accelerates

rhboskres

Publish date: Fri, 21 May 2021, 03:21 PM

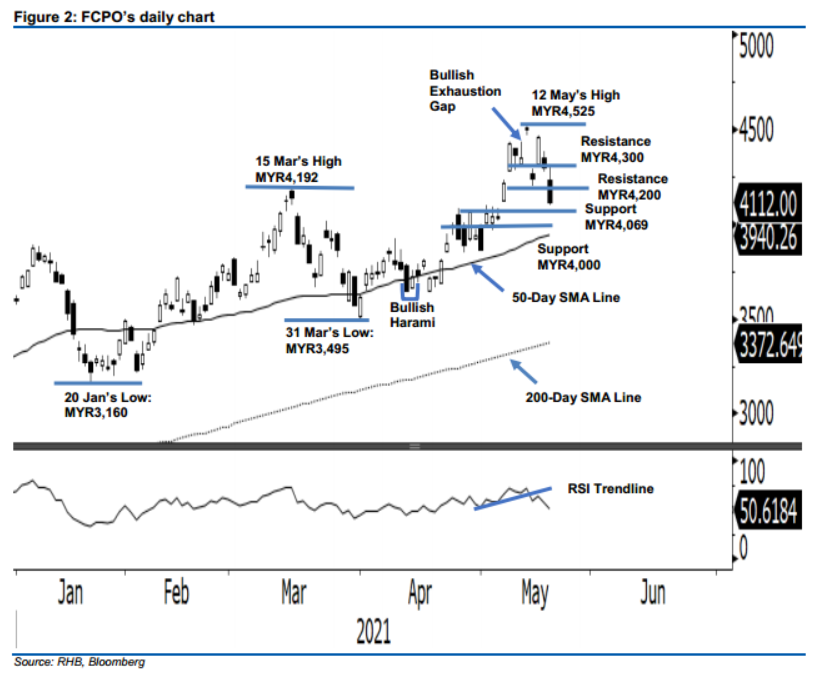

Stop-loss triggered; initiate short positions. The FCPO fell sharply yesterday amid closing MYR190 weaker at MYR4,112 – negating the Island Reversal pattern. The commodity began the session with a gap down at MYR4,232, then moved in a whipsawed pattern to first touch the day’s high of MYR4,311, before reversing to its low at MYR4,100 and closing at MYR4,112. The strong negative momentum yesterday marked the beginning of the downward momentum. Coupled with the RSI pointing lower, the negative momentum may follow through to test the 50-day SMA line or, at least, the nearest support level of MYR4,069. As mentioned in our previous note, the commodity is trading in a volatile environment now – it may see a technical rebound in the immediate term before trending lower. Since the stop loss has been triggered, we switch from positive to a negative trading bias.

We closed out the long positions, which were intitated at the closing level of 18 May at MYR4,457, after triggering the stop-loss at MYR4,277. Conversely, we initiate short positions at the closing level of 20 May. To manage risks, a stop loss can be placed above MYR4,350.

The support levels are revised at MYR4069 or 27 Apr’s closed, followed by MYR4,000, the psychological level. Towards the upside, the resistance levels are pegged at MYR4,200, and subsequently, MYR4,300.

Source: RHB Securities Research - 21 May 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024