FKLI - Selling Pressure Heightens

rhboskres

Publish date: Mon, 24 May 2021, 10:19 AM

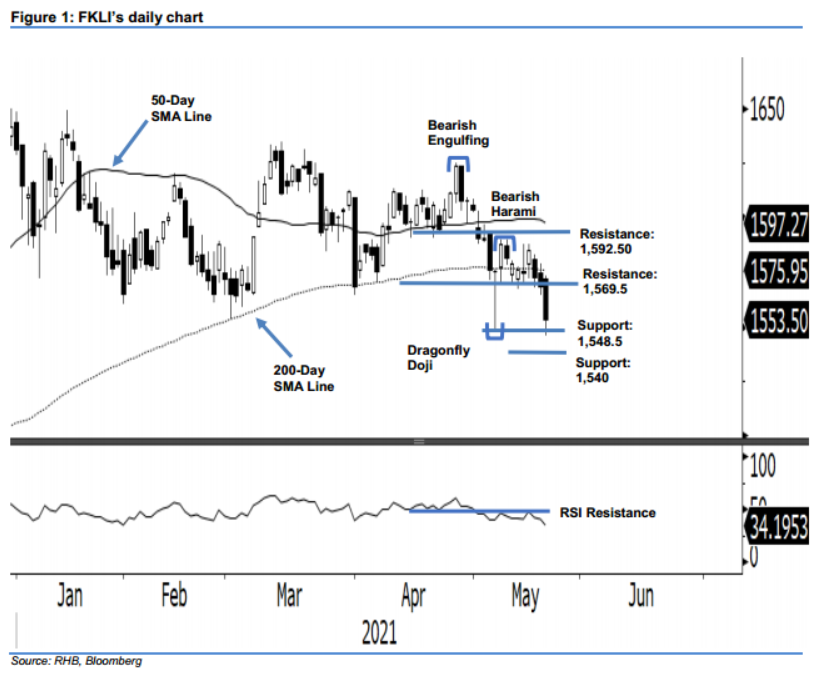

Maintain short positions, while moving down stop-loss level. The FKLI saw negative momentum accelerate while breaching its immediate support – plunging 15 pts to close at 1,553.5 pts on last Friday. Despite the index opening stronger at 1,572 pts, it only tapped its high of 1,573.6 pts before swiftly changing its direction towards south to touch the day’s low of 1,545.5 pts. The index then rebound mildly from its low to close at 1,553.5 pts. The latest price action saw the index moving further away from its 200-day SMA line. Meanwhile, the strong negative momentum displayed last Friday was a strong sign of a downward direction for the medium to long term. Coupled with the RSI pointing south nearing the 30% level, the bears are still in control. This is line with our previous note that the index may retest the 1,548.50 strong support. As such, we reiterate our negative trading bias.

We recommend traders to remain in short positions. We initiated these at 1,568.5 pts, which is at the closing level of 20 May. To manage risks, the stop-loss is revised to 20 May’s high of 1,579 pts.

The immediate support level is revised to 1,548.5 pts, followed by 1,540 pts. Towards the upside, the resistance levels are changed at 1,569.5 pts or 17 May low, and 1,592.5 pts, or 5 May’s high.

Source: RHB Securities Research - 24 May 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024