FCPO - Negative Momentum Accelerates Further

rhboskres

Publish date: Mon, 24 May 2021, 10:19 AM

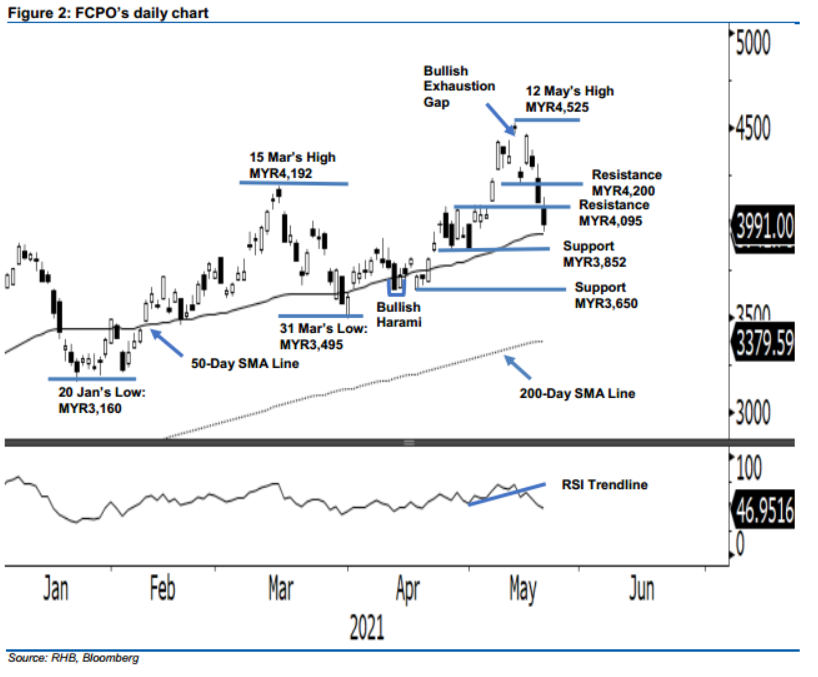

Maintain short positions, with a lower stop-loss level. The FCPO fell sharply again last Friday while closing MYR121 lower at MYR3,991– sitting on the 50-day SMA line. The index opened lower at MYR4,078 before it whipsawed in a downwards direction between MYR4,134 of the day’s high and MYR3,854 of the day’s low to close lower at MYR3,991. The strong negative momentum last Friday signifies the bears are in control. If the commodity breaks below the 50-day SMA line, the negative momentum may extend towards the 200-day SMA line. However, buying interest is expected to be present near its 50-day SMA line. Since the commodity is trading in a volatile environment as of late – it may see a technical rebound in the immediate term before trending lower. Premised on strong negative momentum, we stick to our negative trading bias.

Traders should remain in short positions. We initiated these at MYR4,112 or the closing level of 20 May. To manage risks, a stop-loss is revised to MYR4,200.

The support levels are revised at MYR3,852 or 26 Apr’s low, followed by MYR3,650, or 16 Apr’s low. Towards the upside, the resistance levels are adjusted at MYR4,095 – 3 May’s high and subsequently, MYR4,200.

Source: RHB Securities Research - 24 May 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024