E-Mini Dow - Testing the Resistance

rhboskres

Publish date: Tue, 25 May 2021, 10:19 AM

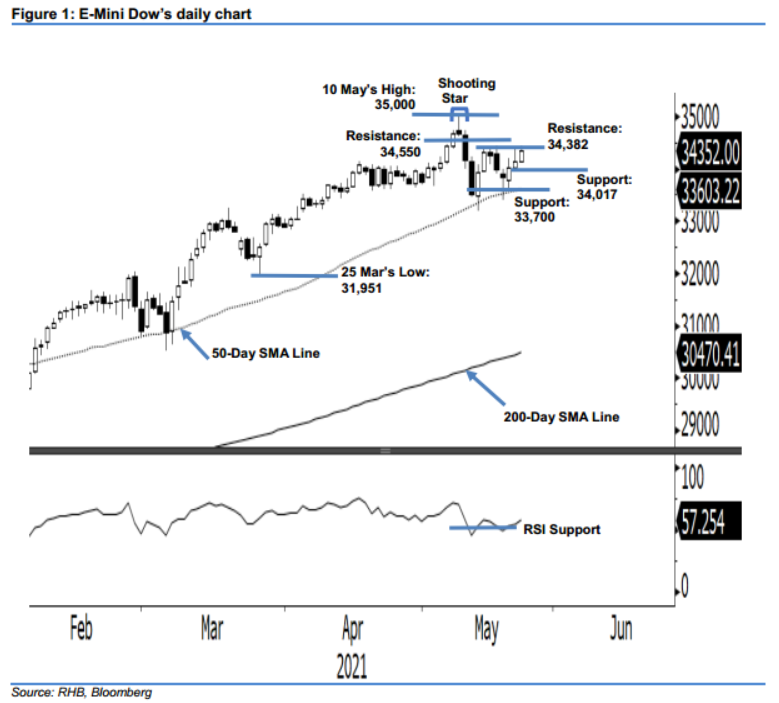

Stop-loss triggered; Initiate long positions. The E-Mini Dow managed to recoup its previous week’s losses, and saw bullish momentum extend yesterday, rising 199 pts to settle at 34,352 pts. After starting Monday’s session at 34,150 pts, the index established the day’s low at 34,101 pts. Thereafter, it swung back to upward trajectory to reach the day’s high of 34,427 pts before settling in at 34,352 pts – giving hope that index may close in positive territory at the end of week. After breaching the stop-loss, it is now heading higher to test the immediate resistance of 34,382 pts. If it clears this resistance, the index will form a “higher high” bullish pattern, further strengthening the current upward movement. On the downside, support is firmly established at the 50-day SMA line. As the stop-loss was breached, we shift to a positive trading bias.

We closed out the short positions initiated at 34,183 pts, or the closing level of 11 May after the stop-loss was triggered at 34,318 pts. Conversely, we initiate long positions at the closing level of 24 May, or 34,352 pts. For risk management purposes, the initial stop-loss is placed at 33,402 pts, or the low of 19 May.

The immediate support is marked at 34,017 pts – the low of 21 May – followed by 33,700 pts. On the upside, the immediate resistance is pegged at 14 May’s high of 34,382 pts, and followed by 34,550 pts.

Source: RHB Securities Research - 25 May 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024