WTI Crude - Bullish Momentum Accelerates

rhboskres

Publish date: Tue, 25 May 2021, 10:19 AM

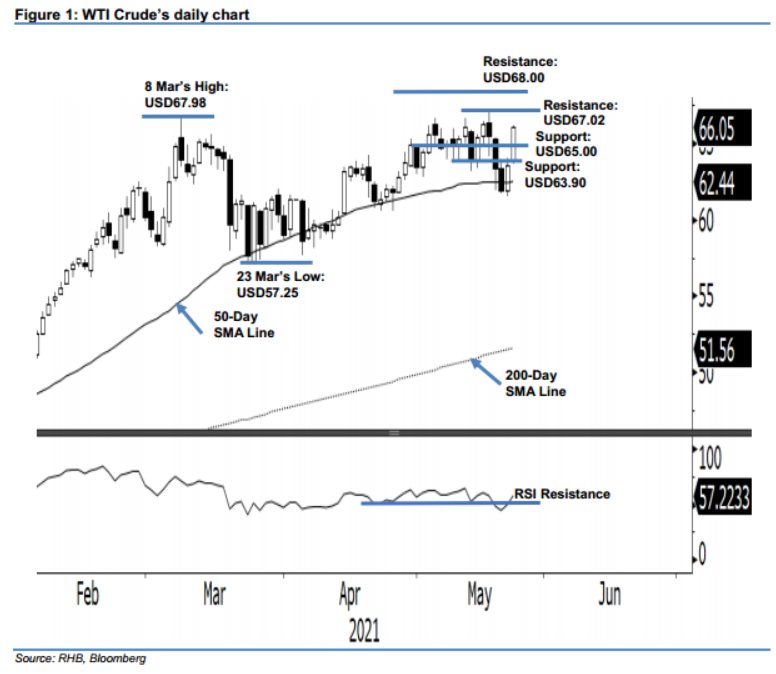

Stop-loss triggered; Initiate long positions. The WTI Crude saw a strong rally yesterday, jumping USD2.47 to settle at USD66.05 – recouping the previous week’s losses. It started Monday’s session flat at USD63.87. After touching the day’s low of USD63.63, it surged towards the day’s high of USD66.14 before settling at USD66.05 – printing the largest daily gain since 14 Apr. Based on the last two sessions, the bulls have overpowered the bears since rebounding from the support of the 50-day SMA line. Crossing above the USD65.00 psychological level also signifies that the uptrend is gaining strength, and has more legs to the upside. As the stop-loss level was breached, the commodity is in the midst of forming a “higher high” bullish pattern. As such, we shift to a positive trading bias.

We closed out the short positions initiated at USD63.82, or 13 May’s closing level, after the stop-loss was triggered at USD64.53. Conversely, we initiate long positions at 24 May’s close of USD66.05. To manage risks, the initial stop-loss is placed at the USD62.00 round figure.

The nearest support is revised to the USD65.00 psychological level, followed by USD63.90, or the low of 7 May. The immediate resistance is eyed at USD67.02 – the high of 18 May – followed by USD68.00.

Source: RHB Securities Research - 25 May 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024