FCPO - Falling Below The 50-Day SMA Line

rhboskres

Publish date: Tue, 25 May 2021, 10:19 AM

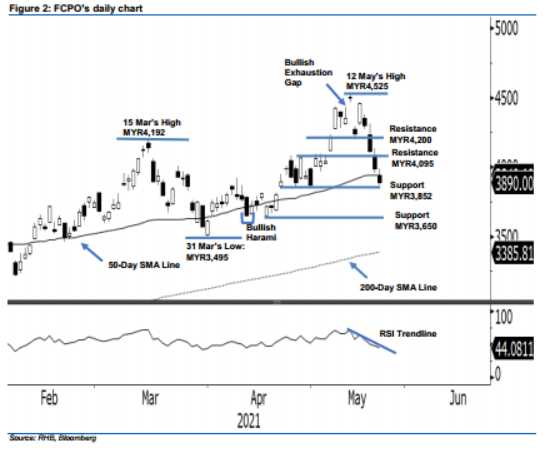

Maintain short positions. The FCPO extended its downward momentum for the fourth day in a row after it plunged MYR101 yesterday to close below its 50-day SMA line – depicting a continuation of the negative momentum ahead. The commodity opened lower at MYR3,942, then oscillated in a negative trend between MYR3,990 and MYR3,867 to close lower at MYR3,890. The strong negative momentum yesterday reaffirms that the bears are still in control after breaching below the 50-day SMA line, which may likely to move south towards the 200-day SMA line. As mentioned earlier, since the commodity is trading in a volatile environment, it may see a technical rebound in the immediate term. However, the counter-trend rebound should be regarded as a minor movement within a major movement, which is heading downwards. Premised with that, we hold on to our negative trading bias.

Traders should stick to short positions. We initiated these at MYR4,112, or the closing level of 20 May. To manage risks, a trailing-stop is pegged at MYR3,990.

The support levels stay at MYR3,852 or 26 Apr’s low, followed by MYR3,650, or 16 Apr’s low. Towards the upside, the resistance levels remain at MYR4,095 – 3 May’s high and then, MYR4,200.

Source: RHB Securities Research - 25 May 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024