Hang Seng Index Futures - the Bullish Momentum Remains

rhboskres

Publish date: Fri, 28 May 2021, 05:23 PM

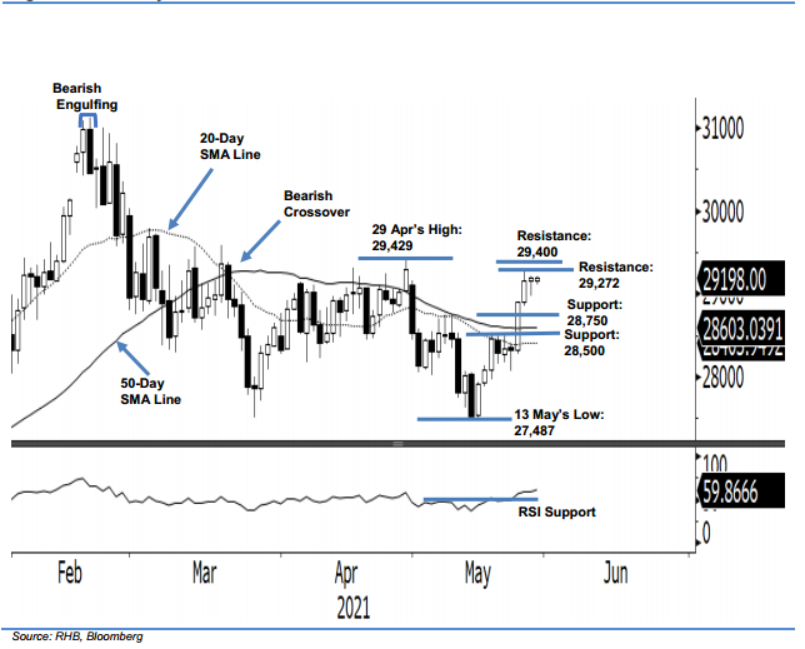

Maintain long positions. The HSIF saw its recent bullish momentum staying intact, adding 30 pts to settle the day session at 29,185 pts. It started at 29,149 pts yesterday and, although there was mild selling pressure during the early session, the index managed to find foothold at the 28,962-pt day low. It rose to the 29,202-pt day high before closing at 29,185 pts. The HSIF rose higher during the evening session – it last traded at 29,198 pts. Although the futures contracts are coming nearer to their month’s end expiries, momentum has not waned and is poised to test the 29,272- and 29,400-pt resistances. A sustained move above both may see the bulls eye 29,429 pts, or the 2-month high. We do not rule out there being a pullback due to the contracts’ expiries, but expect both the 20- and 50-day SMA lines to lend strong support. Since the bullish momentum is gaining traction, we retain our positive trading bias.

Traders should maintain long positions, which we initiated at 28,894 pts, or the closing level of 25 May’s day session. For risk-management purposes, the initial stop-loss level is fixed at 28,400 pts.

The immediate support is rmarked at 28,750 pts, followed by the 28,500-pt round number. On the upside, the immediate resistance is seen at the high of 26 May – 29,272 pts – and followed by 29,400 pts.

Source: RHB Securities Research - 28 May 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024