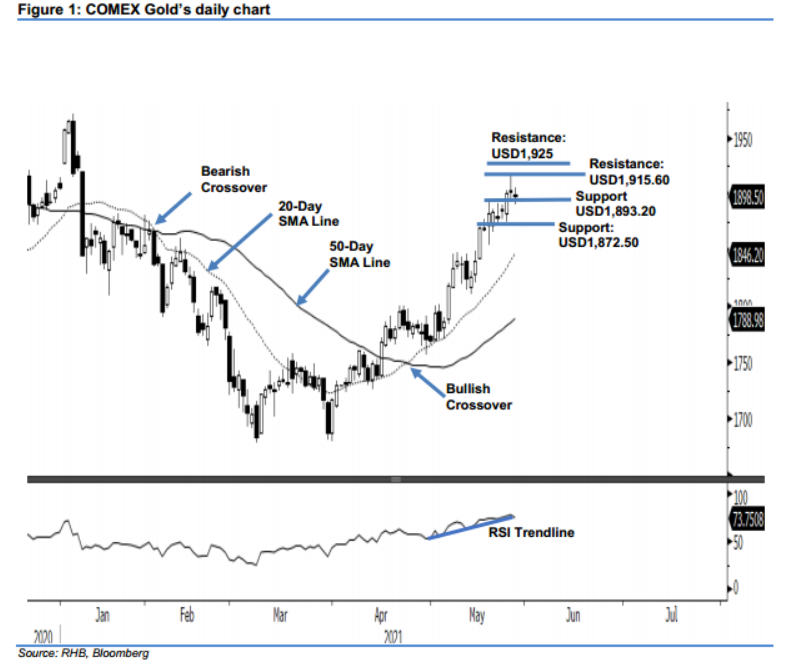

COMEX Gold - Consolidating Near the USD1,900 Level

rhboskres

Publish date: Fri, 28 May 2021, 06:02 PM

Maintain long positions. The COMEX Gold took a breather after its recent rally, dipping USD5.30 to close at USD1,898.50. The commodity started Thursday’s session at USD1,899.30. After fluctuating between the session high and low of USD1906.50 and USD1,890.80, it closed at USD1,898.50 – marginally below the USD1,900 level. After a recent strong rally from USD1,800, it may start to consolidate and move sideways. As long as the COMEX Gold does not breach below USD1,870, we deem the current bullish structure as intact – we may see upward movement again post consolidations. Falling below USD1,870 may see a deeper correction towards the 20-day SMA line. As long as it consolidates and stays above USD1,870, we stick to our positive trading bias.

Traders should maintain the long positions initiated at USD1,791.80, or the closing level of 3 May. For risk management purposes, the trailing-stop threshold is set at USD1,870.

The immediate support is revised to USD1,893.20, which was the high of 19 May. This is then followed by USD1,872.50, or the low of 21 May. The nearest resistance is seen at 26 May’s high of USD1,915.60, followed by USD1,925

Source: RHB Securities Research - 28 May 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024