E-Mini Dow - Edging Higher

rhboskres

Publish date: Fri, 28 May 2021, 06:03 PM

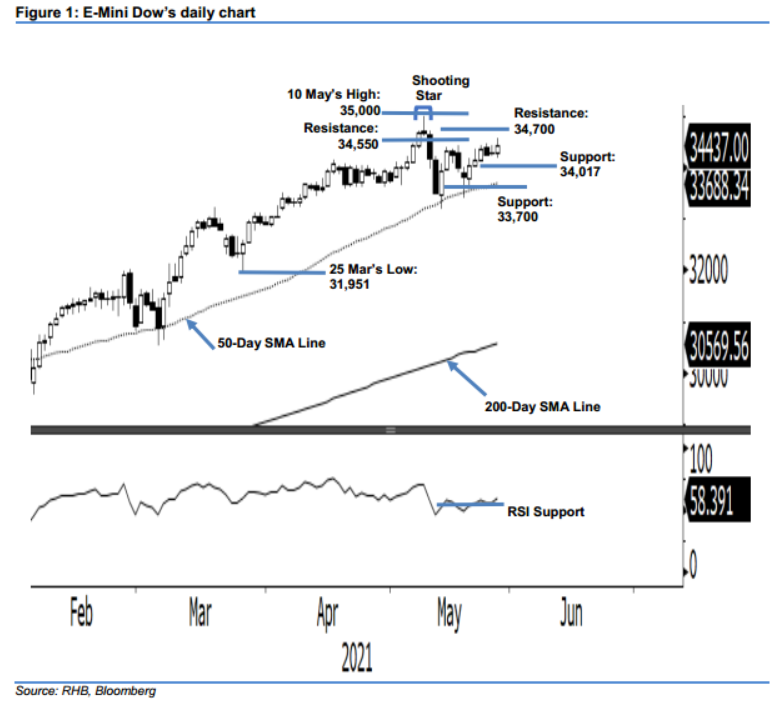

Maintain long positions. The E-Mini Dow resumed its upward movement yesterday, rising 157 pts to settle at 34,437 pts – reaching a 2-week high. It started Thursday’s session stronger at 34,295 pts. After forming the day low at 34,170 pts, buying interest emerged during the US trading sessions to lift it towards the 34,577-pt day high before settling in at 34,437 pts. With the recent positive price action, the index is poised to test its nearest resistance – 34,550 pts – and followed by a higher hurdle at 34,700 pts. If it manages to cross both, it may then challenge 2021’s high and neutralise the Shooting Star bearish pattern at the top. While staying optimistic on the upside potential, we do believe the selling pressure may persist at the overhead resistance, but expect a mild pullback. Since the E-Mini Dow is shifting back towards a bullish momentum, we stay with our positive trading bias.

We recommend traders maintain the long positions initiated at 34,352 pts, or the closing level of 24 May. For risk management purposes, the initial stop loss is fixed at 33,700 pts.

The immediate support remains at 34,017 pts – the low of 21 May – and followed by 33,700 pts. On the upside, the immediate resistance is revised to 34,550 pts, followed by 34,700 pts.

Source: RHB Securities Research - 28 May 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024