WTI Crude - Testing the USD67.00 Level

rhboskres

Publish date: Fri, 28 May 2021, 06:03 PM

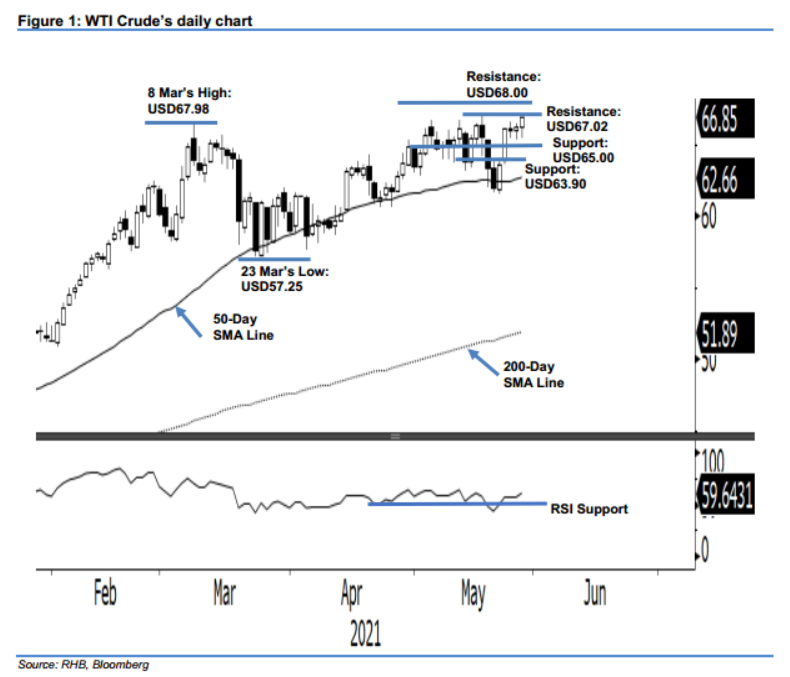

Maintain long positions while moving the stop loss higher. The WTI Crude saw strong demand emerging yesterday, jumping USD0.64 to settle at USD66.85 – the commodity is on the verge of testing USD67.02, or the high of May. It began Thursday’s session at USD66.16. The momentum was initially weak, which saw it falling to the day low at USD65.47. However, strong demand surged during the US trading hours – this sent the black gold towards the day high at USD66.92 before closing at USD66.85. Due to the rapid rise in prices, the WTI Crude may see a mild pullback to re-test USD66.00 level. With the RSI pointing upwards, it is likely that it will extend the upward movement to test the USD68.00 resistance in the near future. Underpinned by the recent bullish momentum, we maintain our positive trading bias.

Traders should stick to the long positions initiated at USD66.05, or the closing level of 24 May. To manage risks, the stop-loss threshold is revised to USD63.90.

The nearest support remains at the USD65.00 psychological level, followed by USD63.90 – the the low of 7 May. The immediate resistance is sighted at USD67.02, ie the high of 18 May, and followed by USD68.00.

Source: RHB Securities Research - 28 May 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024