FKLI - Jumping Towards 50-Day SMA Line

rhboskres

Publish date: Mon, 31 May 2021, 10:05 AM

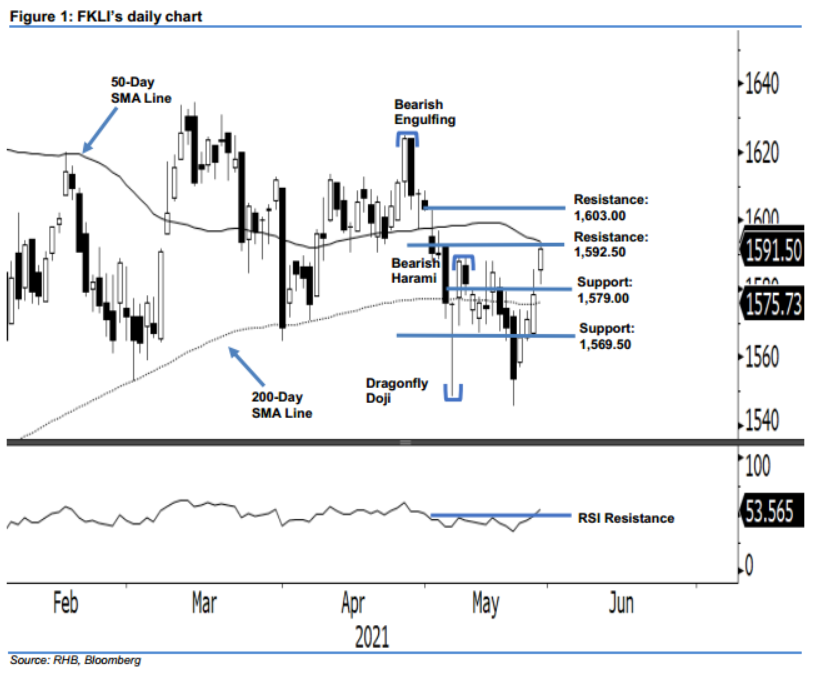

Stop-loss triggered; initiate long positions. The FKLI printed another bullish candle for the fourth day in a row last Friday, jumping 13 pts to close slightly below the 50-day SMA line last Friday. The index opened stronger with a gap at 1,585.5 pts and retraced to tap the day’s low of 1,581 pts, before it shot upwards to the day’s high of 1,593.5 pts to close the session at 1,591.5 pts. As mentioned in the earlier note, the index should travel upwards if it stays above the 200-day SMA line. Premised with the formation of a “higher high” in the latest session, the FKLI has exceeded the “Bearish Harami” line marked on 10 May. This solidifies the bullish momentum, so it is now more likely to move higher in the medium term. Since the stop-loss has been breached, we switch our trading bias to a positive one.

We closed out the short positions – which were initiated at 1,568.5 pts, or the closing level of 20 May – after triggering the stop-loss at 20 May’s high of 1,579 pts. Conversely, we initiate long positions at the closing level of 28 May at MYR1,591.50. To manage risks, the initial stop-loss is placed below 1,569 pts.

The immediate support level is revised to 1,579 pts, followed by 1,569.5 pts. Towards the upside, the resistance levels are revised to 1,592.5 pts, which was 5 May’s high and, subsequently, 1,603.0 pts, which was 3 May’s high.

Source: RHB Securities Research - 31 May 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024