Hang Seng Index Futures - Whipsaw Near the 29,000-Pt Level

rhboskres

Publish date: Tue, 01 Jun 2021, 10:05 AM

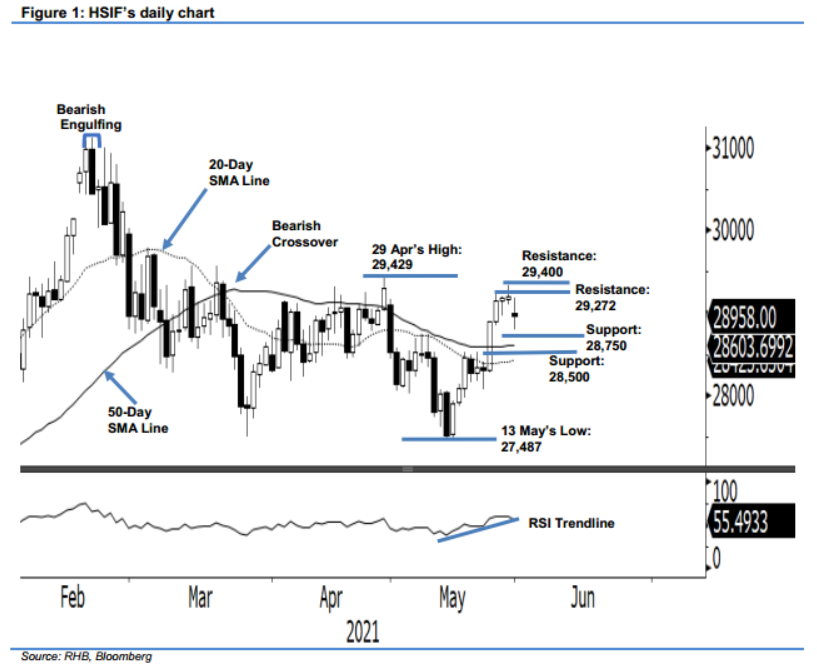

Maintain long positions. The HSIF dipped below the 29,000-pt psychologcial level, settling the day session at 28,958 pts. It initially started Monday’s day session at 29,184 pts – it then fell to the 28,791-pt day low before rebounding higher to close at 28,958 pts. Due to the bank holidays in the UK and US, there were no after-hours trading sessions yesterday. Although there was some selling pressure during the early session, the HSIF managed to climb higher during the late session – indicating that the bulls are still supportive of bargain hunting. Since the RSI has managed to stay above the 50% threshold, we expect the bullish momentum to resume in the coming sessions. In the event the index moves lower in the coming sessions, the 50-day SMA line will act as a strong support. Premised on this, we are keeping to our positive trading bias.

Traders should keep to the long positions initiated at 28,894 pts, or the closing level of 25 May’s day session. For risk-management purposes, the initial stop-loss level is set at 28,400 pts.

The immediate support remains at 28,750 pts, followed by the 28,500-pt round figure. Conversely, the immediate resistance is placed at the high of 26 May or 29,272 pts, and followed by 29,400 pts.

Source: RHB Securities Research - 1 Jun 2021