WTI Crude - Attempting to Cross the USD67.00 Level

rhboskres

Publish date: Tue, 01 Jun 2021, 10:05 AM

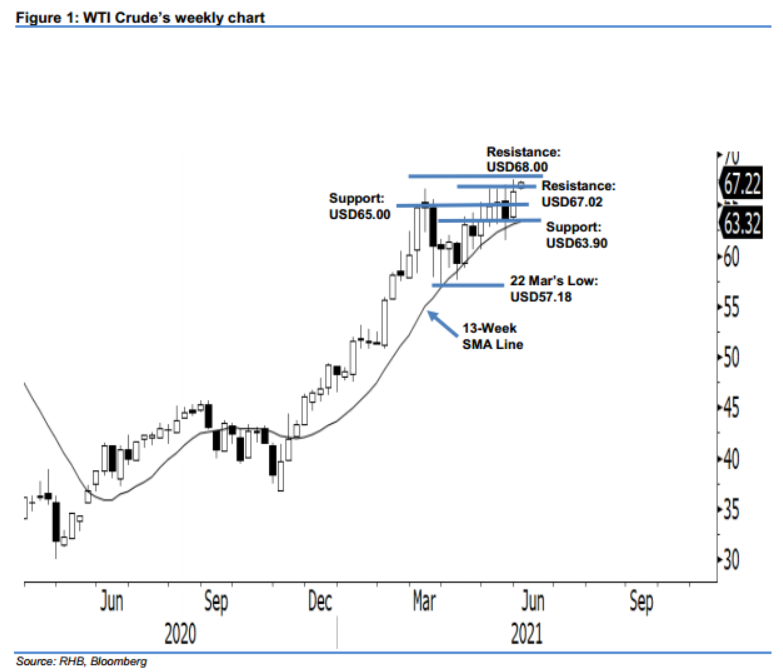

Maintain long positions. The WTI Crude managed to form footing at the 13-week SMA line, climbing higher last week to settle at USD66.32 to form a bullish weekly candlestick pattern. After it crossed above the 13-week SMA line in Nov 2020, the commodity has been climbing upwards and forming a series of “higher highs and higher lows”. As long as the black gold continues to trade above the 13-week SMA line, it will retain its bullish structure. Underpinned by this bullish momentum, the WTI Crude will very likely edge higher to test the USD67.02 and USD68.00 resistances. The USD63.90 mark will act as a strong support for the commodity – it also intersects with the 13-week SMA line. Breaking below the support level may mark the beginning of a correction phase. Since the bullish structure stays intact, we hold on to our positive trading bias.

Traders should stick to the long positions initiated at USD66.05, or the closing level of 24 May. To manage risks, the stop-loss threshold is set at USD63.90.

The nearest support maintained at the USD65.00 psychological level, followed by USD63.90, or the low of 7 May. The immediate resistance remains at USD67.02, or the high of 18 May. This is followed by USD68.00.

Source: RHB Securities Research - 1 Jun 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024