COMEX Gold - Edging Higher to Test the Resistance

rhboskres

Publish date: Tue, 01 Jun 2021, 10:05 AM

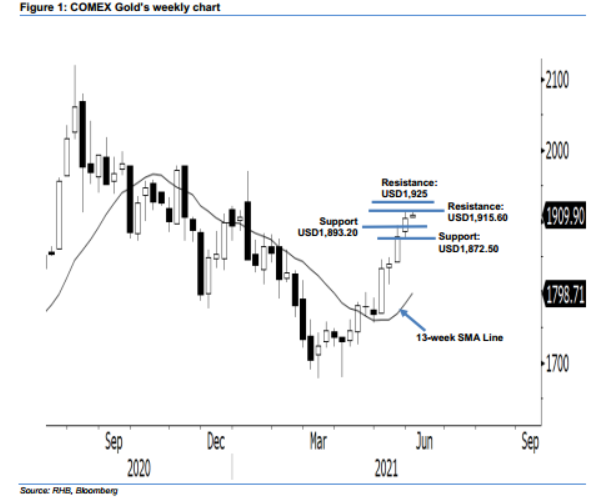

Maintain long positions. The COMEX Gold is recording a fourth consecutive positive week after rising higher last Friday to close at USD1,905.30. During the week, the commodity formed a fresh “higher high” after recording the high of the week: USD1,915.60. Since observing it crossing above the 13-week SMA line during April, the COMEX Gold has been riding higher on a positive momentum. Although the precious metal is trading far apart from the 13-week SMA line – and may be subject to a correction in the coming weeks – we expect the USD1,893.20 and USD1,872.50 levels to provide strong support in the immediate term. Since the commodity did not show any signs of fatigue or bearish reversal patterns, we maintain our positive trading bias.

Traders should maintain the long positions initiated at USD1,791.80, or the closing level of 3 May. For risk management, the trailing-stop threshold is set at USD1,870.

The immediate support is unchanged at USD1,893.20, or the high of 19 May. This is followed by USD1,872.50, ie the low of 21 May. The nearest resistance is sighted at 26 May’s high of USD1,915.60 and followed by USD1,925.

Source: RHB Securities Research - 1 Jun 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024