Hang Seng Index Futures - Crossing Above the 29,000-Pt Level

rhboskres

Publish date: Wed, 02 Jun 2021, 10:08 AM

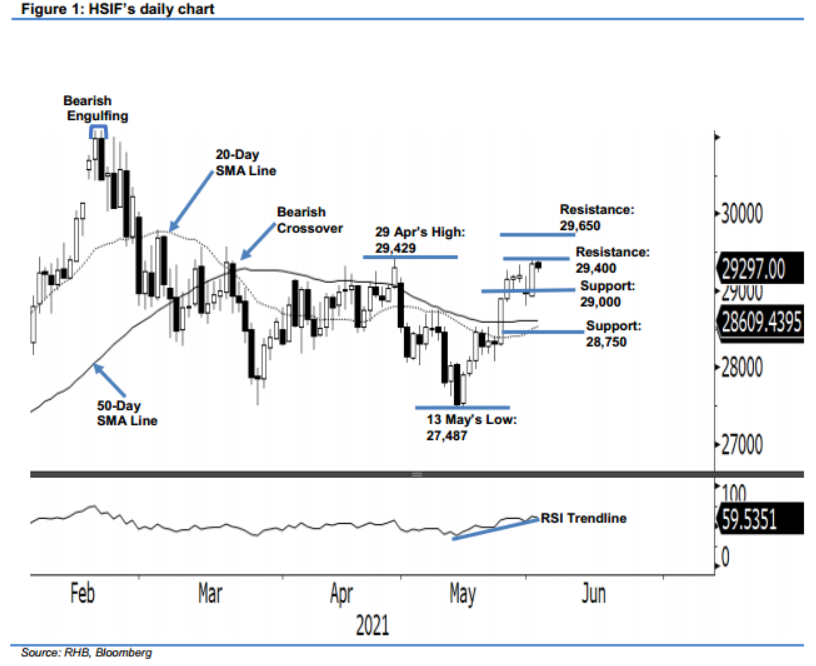

Maintain long positions. After mild consolidations, the HSIF saw the bulls regaining strength during the first trading session of the month, surging 392 pts to settle the day session at 29,350 pts. It initially gapped down during Tuesday’s day session to start weaker at 28,930 pts. However, it found the day low at 28,923 pts and reversed to progress upwards – reaching the 29,400-pt day high before closing at 29,350 pts. Mild profit-taking in the evening brought the index lower – it recorded 29,297 pts at last trade. Based on the latest price action, the bulls remain in the driver’s seat and will very likely attempt to cross the 29,400-pt resistance level soon. Breaching this level may see the HSIF continuing to climb towards 29,650 pts. A 20-day crossover above the 50-day SMA line will further strengthen the current upward movement. Since the bullish momentum stays intact, we hold on to our positive trading bias.

Traders should maintain the long positions initiated at 28,894 pts, or the closing level of 25 May’s day session. For risk-management purposes, the initial stop-loss level is placed at 28,400 pts.

The immediate support is revised to the 29,000-pt psychological level, followed by 28,750 pts. On the upside, the immediate resistance is sighted at the high of 1 Jun, or 29,400 pts, followed by 29,650 pts.

Source: RHB Securities Research - 2 Jun 2021