FCPO - Strong Profit Taking After a Gap Up

rhboskres

Publish date: Fri, 04 Jun 2021, 05:49 PM

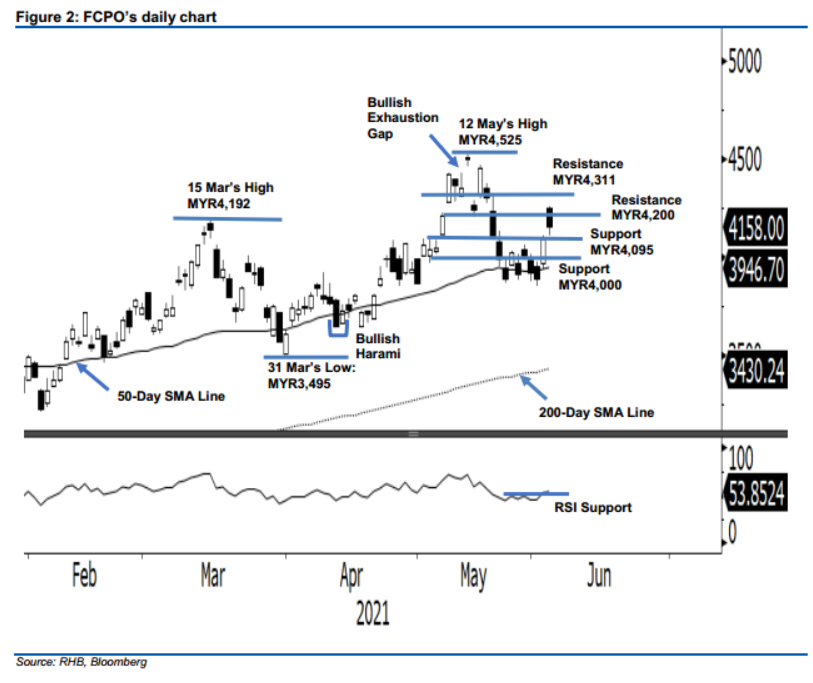

Maintain long positions. The FCPO’s strong bullish momentum during yesterday’s opening session was partially offset by strong negative momentum throughout the session later – however, it still moved MYR66 higher compared with previous session. The commodity started with a gap up at MYR4,249 to tap the day’s high at MYR4,260 before profit taking took place towards its day’s low at MYR4,111. Buying interest emerged mildly at the end of the session to settle at MYR4,158. The strong profit taking from the top yesterday signify the negative momentum might continue in immediate term towards level near to 50-day SMA line (MYR3,946.7). This immediate term correction will be confirmed if the commodity falls below the MYR4,095 support level – also the trailing-stop level. Until the trailing-stop level is triggered, we remain our positive bias.

We recommend traders to remain in long positions. We initiated these at MYR4,024, the closing level of 25 May. To manage risks, the trailing-stop is placed below the MYR4,095 level, or 3 May’s high.

The support levels are revised to MYR4,095 which was 3 May’s high, followed by MYR4,000 the psychological level. Towards the upside, the resistance levels are changed to MYR4,200, subsequently at MYR4,311 which was 20 May’s high.

Source: RHB Securities Research - 4 Jun 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024