FKLI - Mild Profit-Taking In Uptrend

rhboskres

Publish date: Fri, 04 Jun 2021, 05:49 PM

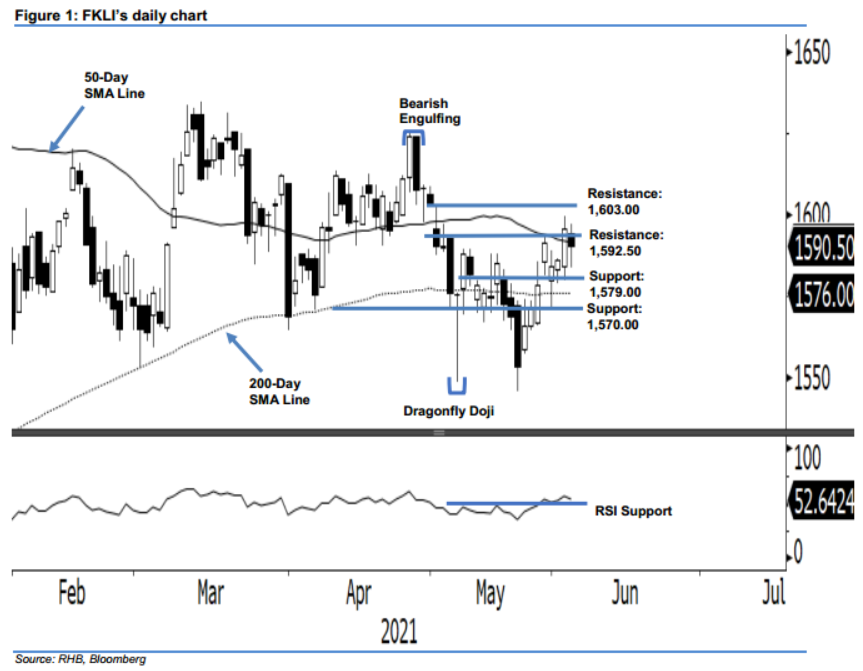

Maintain long positions. The FKLI saw mild profit takings activities yesterday which saw it declined by 5 pts to close below the 50-day SMA line (1,591.3 pts) at 1,590.5 pts. The index opened lower at 1,594 pts to tap the day’s high at 1,597 pts before it shifted downwards, reaching the day’s low at 1,583.5 pts, then rebounded sharply to close at 1,590.5 pts. Though the index fell slightly below the 50-day SMA line, the sharp rebound in the late trading hour yesterday offset partially the negative momentum and spark the buying interest for the coming sessions. Furthermore, the “higher low” structure above the 200-day SMA line remain intact. As the RSI level is still above 50%, the bullish momentum in medium term is expected to remain. Since the stop loss has not triggered, we stay to our positive trading bias.

We recommend traders to stay in long positions. We initiated these at the closing level of 28 May at MYR1,591.50. To mitigate risks, the stop-loss is pegged at 1,579 pts.

The support levels are changed to 1,579.0 pts, and 1,570.0 pts – 31 May’s low. Towards the upside, the immediate resistance level is revised at 1,592.5 pts, followed by 1,603.0 pts – 3 May’s high.

Source: RHB Securities Research - 4 Jun 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024