WTI Crude - Attempting to Cross Above USD69.00

rhboskres

Publish date: Fri, 04 Jun 2021, 05:50 PM

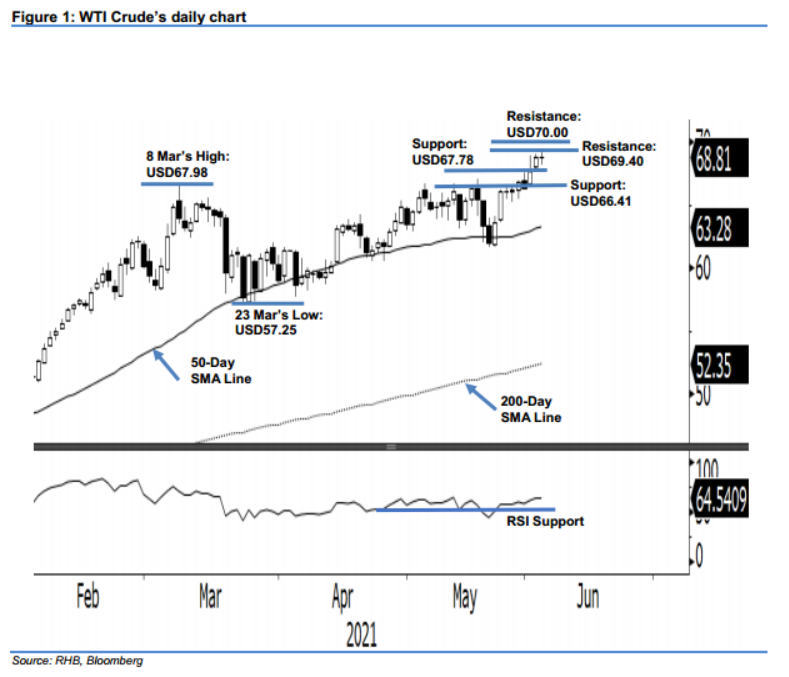

Maintain long positions. After the failure to cross above the USD69.00 level, the WTI Crude dipped USD0.02 to settle at USD68.81. The commodity opened flat at USD68.76 yesterday, rising to test the day high at USD69.40. However, profit taking set in during the European trading hours, where the WTI Crude fell to the USD68.19 day low, before settling in at USD68.81. As mentioned in our previous note, we deem the USD68.00 level as crucial if the commodity is to sustain above this level – the bullish momentum may continue to lift it higher, marking a “new high”. Meanwhile, if profit-taking activities continue, the black gold may drift sideways and see consolidation. Since it has yet to form a “lower low” bearish pattern, we make no change to our positive trading bias.

Traders should stick to the long positions initiated at USD66.05, or the closing level of 24 May. To manage risks, the trailing-stop threshold is set at USD66.41, or the low of 1 Jun.

The nearest support is revised to USD67.78, or the low of 2 Jun, and followed by USD66.41, ie 1 Jun’s low. The immediate resistance is seen at USD69.40 – the high of 3 Jun – and followed by the USD70.00 psychological level.

Source: RHB Securities Research - 4 Jun 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024