Hang Seng Index Futures - Retesting the 50-Day SMA Line Support

rhboskres

Publish date: Fri, 04 Jun 2021, 05:50 PM

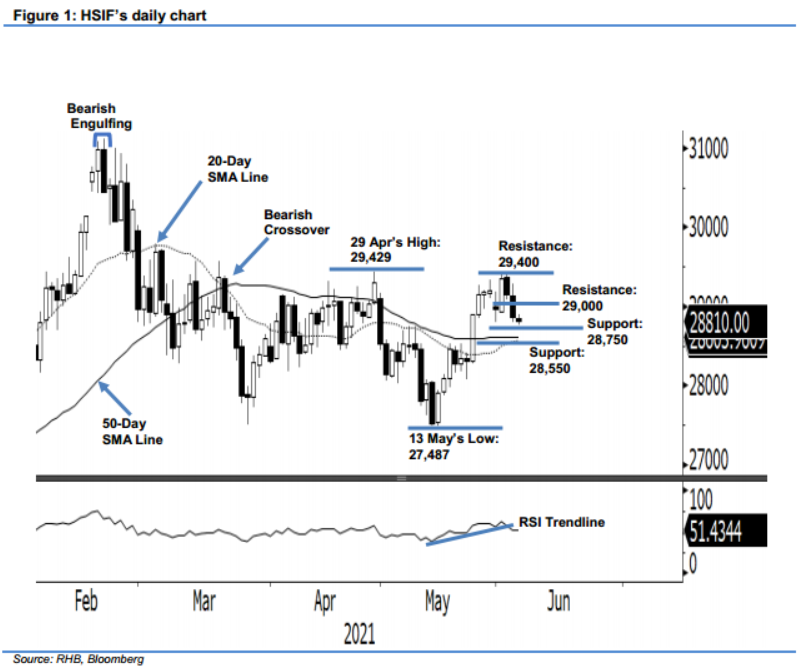

Maintain long positions. The HSIF is retreating from the 2-month 29,400-pt high, dropping 286 pts to settle the day session at 28,858 pts. It initially opened flat at 29,201 pts, rising to test the day’s high of 29,280 pts. Sentiment turned cautious, however, which saw the index facing selling pressure throughout the session – falling to the 28,801-pt day low before last trading at 28,858 pts. The evening session saw the HSIF drop further to close at 28,810 pts. Despite selling pressure dragging the index for two consecutive sessions, we think the 50-day SMA line will provide strong support. Furthermore, if the 20-day SMA line crosses above the 50-day one, this may enhance the technical signal for the current upward movement. As long as the HSIF continues to stay above the moving averages, we deem the current correction as a healthy pullback to test the support level. As such, we retain our positive trading bias.

Traders should maintain the long positions initiated at 28,894 pts, or the closing level of 25 May’s day session. For risk-management purposes, the stop-loss level is placed at 28,550 pts.

The immediate support is revised to 28,750 pts and followed by 28,550 pts. On the upside, the immediate resistance is pegged at the psychological 29,000-pt level, followed by 29,400 pts – the high of 1 Jun.

Source: RHB Securities Research - 4 Jun 2021